2019 Q3 Pathfinder Small Cap Quarterly Report

SEPTEMBER 30, 2019

The Pathfinder Small Cap mandates invest in high-torque, early-stage companies that have the potential to generate superior returns.

Pathfinder Partners’ Fund

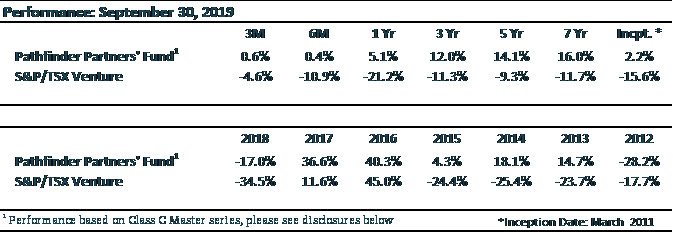

The Partners’ Fund delivered a net return of 20.8% in the first nine months of 2019. This compares to the TSX Venture Exchange which returned 0.3%. Our annualized 7-year return is 16.0% compared to the TSX Venture Exchange’s return of -11.7% per year over the same period. The table below provides a performance summary:

During the quarter, our two largest contributors were Acasti Pharmaceuticals Inc (TSXv:ACST) and Exro Technologies Inc (CSE:XRO), which added 1.8% and 1.2% respectively to gross returns. The largest detractors for the quarter were Terra Firma Capital Corporation (TSXv:TII) and Posera Ltd (TSX:PAY) which contributed gross portfolio losses of 1.0% and 0.8% respectively. Year to date, our top performer is Xebec Adsorption Inc (TSXv:XBC) which added 8.7% to gross returns. No investment has contributed to a gross portfolio loss of over 1% this year.

The TSX Venture has been hampered this year by an epic destruction in the valuation of cannabis related stocks. A quick look at 5 large high-flying cannabis stocks from last year – Canopy, Aurora, Cronos, Tilray, and Aphria – shows that prices in these companies are down more than 70% from last year’s high on average. This rout follows a similar fall in overhyped blockchain/cryptocurrency stocks in 2018. The popping of these bubbles has hurt investors who arrived late to party. As a result, capital has left the small cap market and much of the speculative energy and froth that characterized the Venture in 2016 and 2017 is gone. Small cap stocks are experiencing net outflows as retail investors are once bitten, twice shy. This is the precise environment where we have historically found our best investment opportunities.

The business model of early-stage, venture style companies is to raise external capital to develop products and grow sales until eventually reaching profitability. This business model is threatened when capital is scarce. As these companies seek funding over the next 6 months, we have leverage in negotiating deals, less competition and lower valuations. Despite a tough market, we are fortunate to be in a strong position. We stuck with our established process which involves allocating capital to out-of-favor or ignored sectors and avoiding the hype. This has provided us with positive returns and a strong liquidity profile to take advantage of a distressed market. Our investment pipeline has expanded materially over the past three months and we anticipate actively deploying capital throughout the rest of the year into tax-loss season.

For those who primarily follow the broader market, the weakness in Canadian micro/small caps may come as a surprise. Large cap stocks in North America have recovered from a downturn in late 2018 and currently sit near all-time highs. The market has climbed a ‘wall of worry’ throughout the year. Sentiment is poor with exceptionally scary headlines, leaving investors overweight defensive stocks and cash. We don’t have an opinion on the future in the near-term. The difficulty of predicting what the market will do leads us to believe it is a mug’s game. Our preference is to assess individual companies on a bottom up basis, develop an estimate of what they are worth, and buy them at the largest possible discount to our fair value estimate. This is the same across all Pathfinder mandates. When we examine our current portfolio and pipeline of potential investments, we get very excited because they are trading at a much wider-than-usual discount to what we believe they are worth. This bodes well for future return potential.

Pathfinder Resource Fund

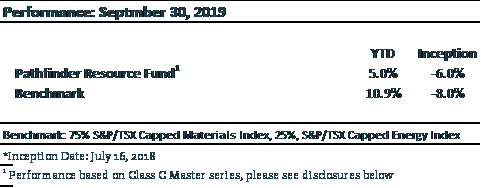

During the quarter, the Resource fund rose 4.1%. This compares to the benchmark return of -0.1%. Since inception (July 16, 2018), the Resource Fund has declined by 6.0% versus the benchmark which declined by 8.0%. The benchmark consists of 75% of the daily return of the S&P/TSX Capped Materials Index and 25% of the daily return of the S&P/TSX Capped Energy Index.

Commodity price performance during the quarter was mixed, as gold performed strongly and copper declined. Our exploration company holdings are mainly driven by discovery, so their prices were less affected by the changing commodity price. However, our advanced developers and producers in the gold space rose, which countered a decline in the advanced developers and producers of copper.

As we have mentioned before, our thesis on commodities and reason for launching the Resource Fund is supply driven. On the gold side, major mining companies have a depleted pipeline and will be unable to maintain production without buying development stage assets to fix this supply problem. On the copper side, there has been a scarcity of new discoveries over the last 20 years as a majority of the easily-discovered deposits that lie at surface have been found and explorers are having to search under cover at depth. Once it starts to take effect, we believe this supply-driven thesis will last years and set up the next bull market in commodities after an unusually long cyclical downturn that has lasted 8 years.

On the individual company front, Integra Resources Corp (TSXv:ITR) announced an excellent PEA that demonstrated an after-tax NPV (5%) of US $358 million and an after-tax IRR of 43% at a US$1350/oz gold price. The project has developed nicely throughout the year and in our opinion, Integra is positioning itself as one of the premiere junior gold explorers and developers. Integra performed strongly over the quarter adding over 1% to gross returns.

We initiated a position in Teck Resources Ltd (TSX:TECK.B) during the summer. The stock subsequently declined as metallurgical coal and copper prices fell. We see a disconnect between the company’s market value and what we believe it is worth. This disconnect is surprisingly wide for a blue-chip mining company and we have taken the opportunity to gradually add to our position as it gets cheaper. Teck appears to share our view that their stock is undervalued as they have recently initiated a share buy-back program.

National Instrument 31-103 requires registered firms to disclose information that a reasonable investor would expect to know, including any material conflicts with the firm or its representatives. Doug Johnson and/or Pathfinder Asset Management Limited are an insider of companies periodically mentioned in this report. Please visit www.paml.ca for disclosures.

* All returns are time weighted and net of investment management fees. Returns from the Partners’ Fund are presented based on the Class C Master series except prior to its inception in July 2011 when the Class A Master series was used. Inception returns include the 10 months from inception in March 2011. Returns greater than one year are annualized. Returns from the Resource Fund are presented based on the Class C Master series since its inception in July 16, 2018. The S&P/TSX Venture Composite Index (C$), the S&P/TSX Venture Composite Index, the S&P/TSX Capped Materials Index and the S&P/TSX Capped Energy Index provide general information and should not be interpreted as a benchmark for your own portfolio return. Further details of the Partners’ Fund are available on request.

Pathfinder Asset Management Limited (PAML) and its affiliates may collectively beneficially own in excess of 10% of one or more classes of the issued and outstanding equity securities mentioned in this newsletter. This publication is intended only to convey information. It is not to be construed as an investment guide or as an offer or solicitation of an offer to buy or sell any of the securities mentioned in it. The author is an employee of PAML, but the data selection, analysis and views expressed herein are solely those of the author and not those of PAML. The author has taken all usual and reasonable precautions to determine that the information contained in this publication has been obtained from sources believed to be reliable and that the procedures used to summarize and analyze such information are based on approved practices and principles in the investment industry. However, the market forces underlying investment value are subject to sudden and dramatic changes and data availability varies from one moment to the next. Consequently, neither the author nor PAML can make any warranty as to the accuracy or completeness of information, analysis or views contained in this publication or their usefulness or suitability in any particular circumstance. You should not undertake any investment or portfolio assessment or other transaction on the basis of this publication, but should first consult your portfolio manager, who can assess all relevant particulars of any proposed investment or transaction. PAML and the author accept no liability of any kind whatsoever or any damages or losses incurred by you as a result of reliance upon or use of this publication.