A Risk of Stagflation?

We have written in the past two issues of the Investment Outlook about recently published high inflation data, primarily in the United States. We thought that we would expand on this discussion by adding a second element. Many investors have expected a soft landing of the US economy and we have seen a significant slow down from where the economy was a year or so ago. This is positive; however, most investors were not expecting a slow down at the same time as an uptick in inflation. A stagnant, slowing or lack luster economy, coupled with rising inflation would not be positive. This situation is called stagflation.

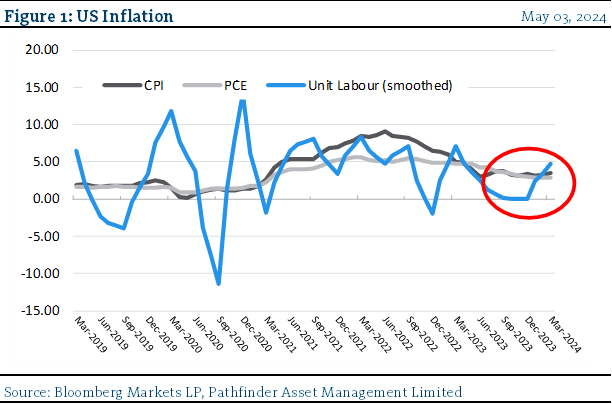

- We have published data from Figure 1 previously and added one more piece of data that indicates more inflationary pressure. The drop in inflation metrics has stalled (grey) while, at the same time, wage pressure has increased (blue). Not great news when the economy is also slowing.

- However, the US Jobs report was released today and it was very weak. The US Quit Ratio was also released and has come down, as have total job openings. A weaker employment market, given the size of the consumer in the US economy, is a significant argument against “the higher for longer” rate argument.

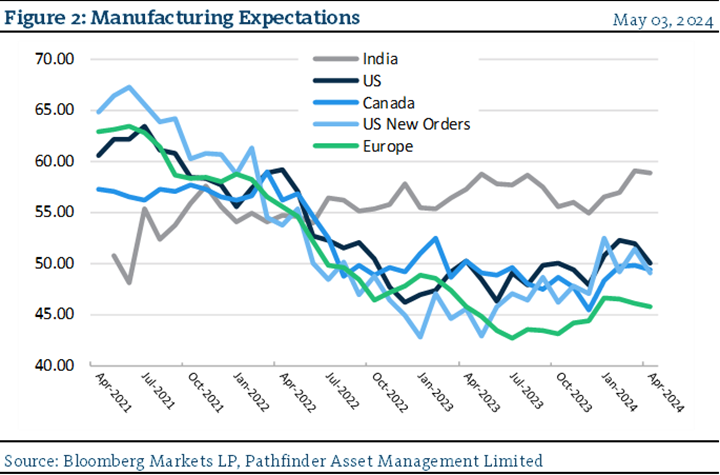

- In Figure 2, we present expectations from manufacturing companies around the world, as well as new order data. After a brief upsurge in the fall and winter of 2023, it looks like expectations have turned negative again for North America. Europe has unfortunately been in contraction since mid-2022 and does not look like it is returning any time soon. India remains the sole steady outperformer.

“This means that” we only want to highlight this as something that we are monitoring. We would need more confirming data to formally adjust our thesis. As always, we will continue to watch this potentially developing risk.

National Instrument 31-103 requires registered firms to disclose information that a reasonable investor would expect to know, including any material conflicts with the firm or its representatives. Doug Johnson and/or Pathfinder Asset Management Limited are an insider of companies periodically mentioned in this report. Please visit www.paml.ca for full disclosures.

Changes in Leverage. We are increasing the asset ceiling to 2.0 times the market value of equity for Pathfinder International Fund and Pathfinder Conviction Fund to be consistent with Pathfinder Partners’ Fund and Pathfinder Resource Fund.

*All returns are time weighted and net of investment management fees. Returns from the Pathfinder Partners’ Fund and Partners’ Real Return Plus Fund are presented based on the masters series of each fund. The Pathfinder Core: Equity Portfolio and The Pathfinder Core: High Income Portfolio are live accounts. These are actual accounts owned by the Pathfinder Chairman (Equity) and client (High Income) which contain no legacy positions, cash flows or other Pathfinder investment mandates or products. Monthly inception dates for each fund and portfolio are as follows: Pathfinder Core: Equity Portfolio (January 2011), Pathfinder Core: High Income Portfolio (October 2012) Partners’ Fund (April 2011), Partners’ Real Return Plus Fund (April, 2013), and Partners’ Core Plus Fund (November 2014).

Pathfinder Asset Management Limited (PAML) and its affiliates may collectively beneficially own in excess of 10% of one or more classes of the issued and outstanding equity securities mentioned in this newsletter. This publication is intended only to convey information. It is not to be construed as an investment guide or as an offer or solicitation of an offer to buy or sell any of the securities mentioned in it. The author has taken all usual and reasonable precautions to determine that the information contained in this publication has been obtained from sources believed to be reliable and that the procedures used to summarize and analyze such information are based on approved practices and principles in the investment industry. However, the market forces underlying investment value are subject to sudden and dramatic changes and data availability varies from one moment to the next. Consequently, neither the author nor PAML can make any warranty as to the accuracy or completeness of information, analysis or views contained in this publication or their usefulness or suitability in any particular circumstance. You should not undertake any investment or portfolio assessment or other transaction on the basis of this publication, but should first consult your portfolio manager, who can assess all relevant particulars of any proposed investment or transaction. PAML and the author accept no liability of any kind whatsoever or any damages or losses incurred by you as a result of reliance upon or use of this publication.