A week(s) of volatility

If you have been following “the markets” over the past number of weeks, you would have noticed a substantial change in sentiment. This first resulted in a leg up in the broad market and then a quick reversal. It is important to take note of these types of changes and how we react because it can help with the understanding of our broader investment management process. We look at companies from a valuation perspective and then compare their prices to the daily number quoted in the stock market. If the prices are below what we consider to be fair, then we will consider adding it to the portfolio. The fair value price that we calculate does not change very often. It is based on the products or services the company provides or sells, its profitability, how much the company reinvests back into “the system” to keep the company going and how management deals with its balance sheet and capital structure. The market on the other hand moves around a lot. This is where the opportunities present themselves… the disconnect between what we believe the company is worth and what it is trading at on a particular day.

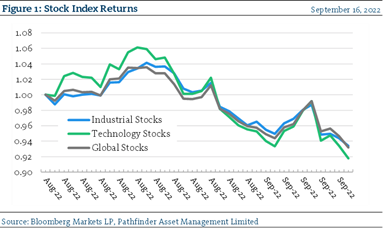

- In Figure 1, we present the price change for industrial, technology and global stocks since the beginning of August. As you can see, over this period markets have been very correlated, indicating that broad macro factors are impacting all assets. Generally, stocks were up into the end of August and have turned, bounced, and then turned again in September. This is what we refer to as volatility.

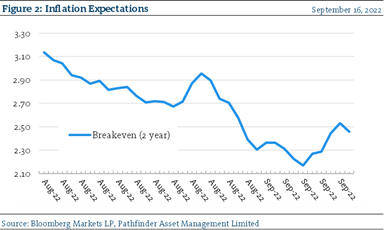

- In Figure 2, we present inflation expectations for the next year over the same period. Here we can see that expectations have moved substantially over the same period. This has translated into volatility in financial assets. We believe that market participants had a somewhat sanguine opinion of the central bank’s ability to get a handle on inflationary pressures. We received some data last week that significantly missed those expectations and that caused another significant change in sentiment.

“This means that” we continue to watch carefully for opportunities. Recently there as been profit warnings from companies and the market has reacted severely. While we still believe that there is potential for further downside, it would present an opportunity to reposition the portfolio into high quality companies. As noted above, the expectations of market participants can change very quickly, and this results in volatility. It is that volatility that ultimately presents opportunities for disciplined investors.

National Instrument 31-103 requires registered firms to disclose information that a reasonable investor would expect to know, including any material conflicts with the firm or its representatives. Doug Johnson and/or Pathfinder Asset Management Limited are an insider of companies periodically mentioned in this report. Please visit www.paml.ca for full disclosures.

*All returns are time weighted and net of investment management fees. Returns from the Pathfinder Partners’ Fund and Partners’ Real Return Plus Fund are presented based on the masters series of each fund. The Pathfinder Core: Equity Portfolio and The Pathfinder Core: High Income Portfolio are live accounts. These are actual accounts owned by the Pathfinder Chairman (Equity) and client (High Income) which contain no legacy positions, cash flows or other Pathfinder investment mandates or products. Monthly inception dates for each fund and portfolio are as follows: Pathfinder Core: Equity Portfolio (January 2011), Pathfinder Core: High Income Portfolio (October 2012) Partners’ Fund (April 2011), Partners’ Real Return Plus Fund (April, 2013), and Partners’ Core Plus Fund (November 2014).

Pathfinder Asset Management Limited (PAML) and its affiliates may collectively beneficially own in excess of 10% of one or more classes of the issued and outstanding equity securities mentioned in this newsletter. This publication is intended only to convey information. It is not to be construed as an investment guide or as an offer or solicitation of an offer to buy or sell any of the securities mentioned in it. The author has taken all usual and reasonable precautions to determine that the information contained in this publication has been obtained from sources believed to be reliable and that the procedures used to summarize and analyze such information are based on approved practices and principles in the investment industry. However, the market forces underlying investment value are subject to sudden and dramatic changes and data availability varies from one moment to the next. Consequently, neither the author nor PAML can make any warranty as to the accuracy or completeness of information, analysis or views contained in this publication or their usefulness or suitability in any particular circumstance. You should not undertake any investment or portfolio assessment or other transaction on the basis of this publication, but should first consult your portfolio manager, who can assess all relevant particulars of any proposed investment or transaction. PAML and the author accept no liability of any kind whatsoever or any damages or losses incurred by you as a result of reliance upon or use of this publication.