Commodities: Portfolio Allocation

Over the past month, we wrote a series on commodities. Please click here to review on our Information Worth sharing page. Commodities prices in general have been increasing and we thought it would be timely to discuss our views.

Prior to the beginning of this year, price increases were more related to the full-on effects of the pandemic. Governments around the world enacted, at the same time, both unprecedented mitigation measures (i.e. lock downs and physical constraints) and significant fiscal & monetary stimulus (various programs that added money into the system). The mitigation measures created unforeseen supply chain issues. The global supply chain is highly connected and highly complex. As one part of the system became bogged down, it impacted others. Products became scarce and prices went up. The fiscal and monetary policies, on the other hand, while critical for keeping the monetary an economic system from collapsing, added more money to an already tight system eventually resulting in structural inflation. Either of these two policies (mitigation or stimulus) in isolation would have been inflationary, but together, they have clearly driven inflation data around the world in new ways that we have not seen for decades.

From the beginning of the year, a new issue resulting from the Russian / Ukrainian geopolitical conflict has now been added into the mix. Prices, from both from a drop in availability (e.g. wheat, neon gas) and from the potential of restrictions (e.g. coal, oil & natural gas) have increased again. While this is not related to the pandemic, it impacts prices in the same way.

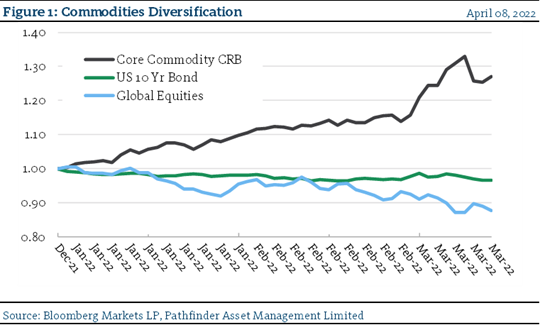

As you might glean from the explanation above, it is extremely difficult to have predictive ability with respect to impacts of a pandemic, war and the resulting government reactions, all at the same time. Regular readers of the Investment Outlook will know we do not try to time these types of events but Figure 1 presents how impactful the results are on financial assets.

“This means that” with both global equities and fixed income falling from the start of the year, the traditional 60/40 balanced portfolio is not performing as one would expect. Both risk and return have been compromised. We believe that some exposure to commodities is an important part of the portfolio balancing process, and it is times like these that prove the theory in practice. Our view is that it is better to have non or low correlated investment streams combined in an overall portfolio. We have found over time that this approach provides more efficient returns over long periods.