Large Cap Annual Review

JANUARY 2021

From the reader’s perspective, this document should be read in conjunction with the “Pathfinder Portfolio Management Overview” report released on January 8, 2021 which explains our overall portfolio management process and investment thesis. Please follow this link here for a copy of the report if you have not seen it yet.

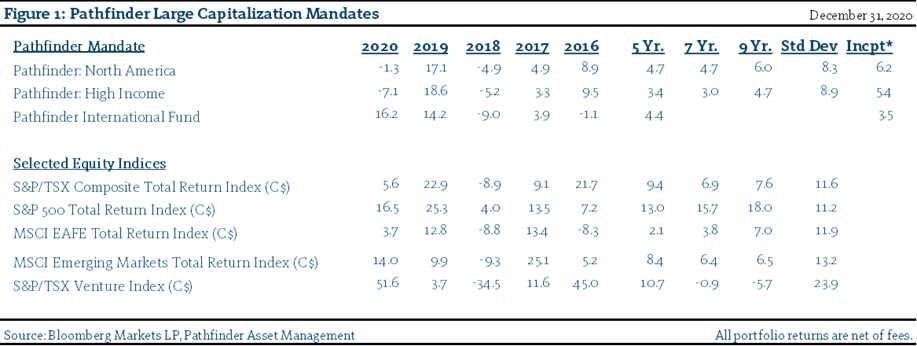

For the calendar year 2020, the North America Equity portfolio returned -1.3% and the High Income portfolio returned -7.1%, while the Pathfinder International Fund returned 16.2 % (please see Figure 1). Since our inception in 2011, both of our segregated portfolios have returned 6.2% and 5.4% annualized to December 31, 2020. We have accomplished this while taking less risk vs. equity markets – between three quarters and two thirds of broad market indices, as measured by annualized standard deviation. Standard deviation is commonly used as a preferred measure of risk (i.e. the monthly fluctuations of your portfolio market value). We have been able to minimize our portfolio standard deviation with two main strategies. First, we invest in companies that are stable cash flow producers and are priced at a discount to their fundamental value. This inherently leads to less volatile portfolios. Second, when the quoted market price of a share of a company that we own rises above what we think will be the best-case scenario for that company, we sell or reduce our investment and allocate that cash to another company that has better value. If we cannot find another company, then we hold the cash in a treasury bill. Holding the cash serves two functions: One, it reduces the risk of the portfolio when we believe prices are too high and two, it provides us an option to buy more shares of good quality companies when those prices are lower. This year, we remain generally satisfied with our investment management execution, but we wish we were more aggressive in deploying our excess cash.

NORTH AMERICAN EQUITY & HIGH INCOME REVIEW

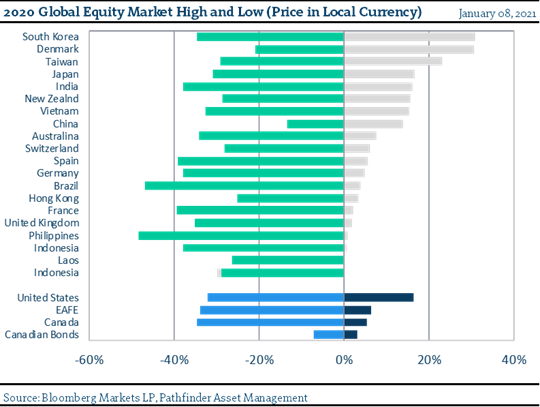

As we noted in our Portfolio Management Overview released in early January, 2020 was a unique year for global equity markets. This came after a volatile 2 years. Many broad indices had a top to bottom drop of just under 20% (the technical definition of a bear market) in 2018 and subsequently rebounded in 2019. The mood was constructive at the start of 2020 but quickly deteriorated into the news of the pandemic and subsequent mitigation measures. We republished the chart below that was released in our Portfolio Management Overview because we find it so striking. The countries are sorted from highest to lowest in terms of return. The green bars show the absolute drawdown (i.e. the market drop) from the beginning of the year to the bottom, while the grey show where they finished. The dispersion is incredibly wide at country level but also for the individual companies we own in the portfolios.

Our stock picking generated good results with most of our positive holdings providing double digit returns for the year. Our biggest win continued to be our technology thesis, while our USD position, financial companies and the energy complex were the detractors. Apple Inc. (US:AAPL) +80.7%, Microsoft Corp (US:MSFT) +41.4%, Alphabet (US:GOOG) +31.3% and newly added Oracle (US:ORCL) +22.1% were the technology winners. Cameco (CN:CCO) +47.7%, Canadian Pacific Railway (CN:CP) +33.4%, Stella Jones (CN:SJ) +23.3% and newly added Nike (US:NKE) +39.6% were also strong performers. In our opinion, valuations had pulled ahead in the technology space and we took the opportunity to lighten our positions in MSFT and APPL over the year but still own a full weight position in GOOG, which is now the largest position in the portfolio. As for our losers, the energy and financials complex contributed most to offset our positive returns in other parts of the portfolio. Arc Resources Ltd (CN:ARX) -26.5, Canadian Natural Resources (CN:CNQ) -27.2%, Fairfax Financial (CN:FFH) -28.8% and Wells Fargo & Co (US:WFC) -43.9% were again our worst performing stocks in the North American Portfolio. More energy names in the High Income portfolio contributed to the lower return in the mandate with Enbridge Inc (CN:ENB) -21.1%, Peyto Exploration & Dev Corp. (CN:PEY) -23.2% TC Energy (CN:TRP) -25.2% detracting this year. For a number of years, commodities stocks have been a very small portion of our portfolios, however, they remain one of the areas where we see the most intrinsic value. Unfortunately, sentiment is poor, and the economic back drop is less constructive, so for the most part, other than a small number of special situations, we remain on the sidelines in the main portfolio. One of the biggest detractors was our US$ position which had fluctuated from just over 30% of the portfolio to just under 20%. While we made many changes to the portfolio during the peak of the spring volatility, in hindsight, we could have put more capital to work. The cash position certainly mitigated the damage to the portfolios with the flight to safety during the violent market days of March and April; however, it ultimately acted as a drag, first as markets rebounded and then as the US dollar lost ground against the Canadian dollar as inflation expectations changed.

We often speak with our clients about the difference between trading the market and investing in companies. At Pathfinder, we invest in companies. We aim to buy good quality companies with stable cash flows at a low price. This means that we often think about, calculate, and debate the value of companies. We generally agree that companies that offer the best value will, over time, provide the best performance results. We have noticed that, for many years now, companies that have traditionally offered the best value have underperformed. We remain confident in the strategy over the long-term and are even more comfortable given that the portfolio is used as an anchor and in the combination with other more aggressive mandates that Pathfinder offers.

PATHFINDER INTERNATIONAL FUND

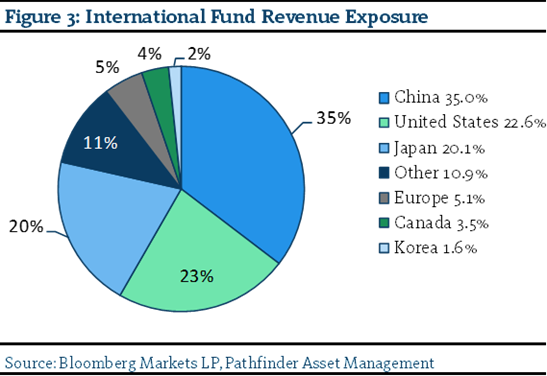

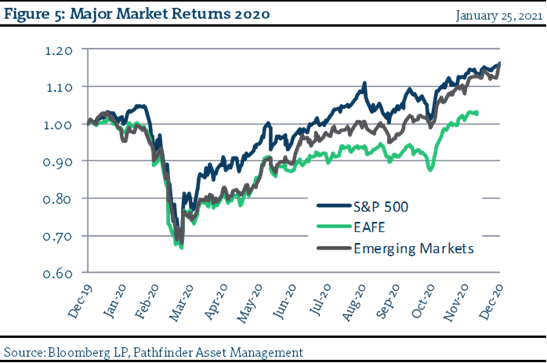

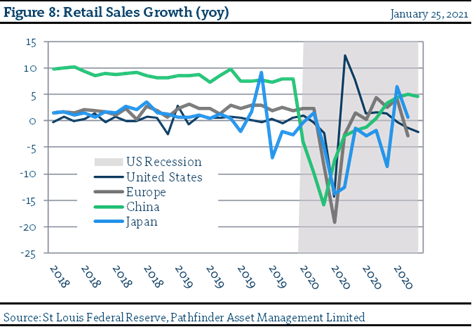

International markets rebounded from the initial drop of -33.9% to finish the year essentially flat for 2020. Developed markets like Japan and Europe had a difficult year while the Chinese economy was the only positive performing major economy in the world. Markets there responded accordingly. For the year, the Pathfinder International Fund returned 16.2% while international markets as defined by the MSCI EAFE Index were up 3.7% in Canadian Dollar terms. We have been quite active in the fund over the course of the year and are very comfortable with its strategy and positioning going forward. Throughout most of 2019, we had established positions in several Chinese companies. We had also focused the portfolio along an electrification and automation theme, which further tilted our investments towards technology companies in general and China specifically in 2020. As we were paying close attention to that part of the world, we were able to get early notice from the news media when the pandemic broke out and could position accordingly. We had a large cash position coming into the year across all of our mandates; however, in the International Fund, we increased that position and added a short on the general Chinese market using broadly traded ETFs. When the volatility of the pandemic hit, we were just under 50% of the portfolio in cash and net zero weight in Chinese stocks. Thus, our absolute draw down at the peak of the bear market was only 8% against almost -34% for the EAFE. We also had the benefit of being long Chinese technology stocks which did very well during China’s mitigation phase and short the general index, which had far more financial and real estate companies that did not perform well at that time. We covered our short position when it became clear that China was able to mitigate the impact of the virus and real time traffic and power data showed a quicker normalization of the economy. In the end, markets rallied back and we were able to post a strong return for the year. Kingdee International Software (HK:268) +305.6%, Jd.Com Inc (US:JD) +149.5%, Daifuku Co Ltd (JP:6838) +91.6% and Taiwan Semiconductor (US:TSM) +87.7% were our best performers while Fairfax India (CA:FIH/U) -25.0% was our worst. Much like the North American Portfolio, in hindsight, I could have been much more aggressive about putting our cash reserves back to work but we remain satisfied with the results this year.

PORTFOLIO STATISTICS

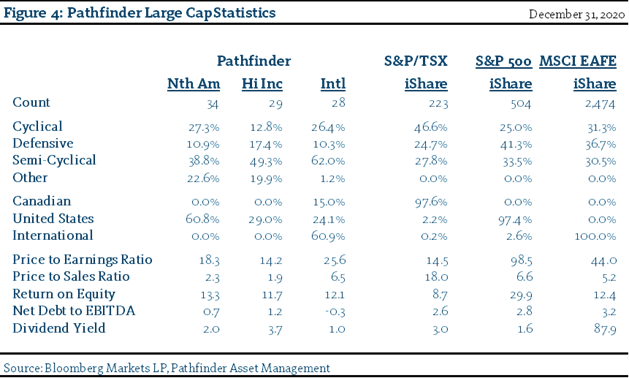

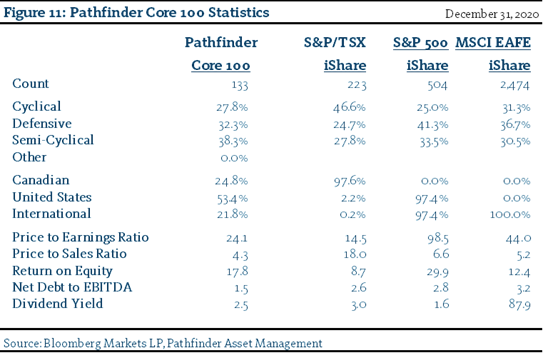

We include Figure 4, which presents the difference between the Pathfinder Large Cap mandates and three large exchange trade funds. We think that this is the most appropriate comparison for our approach. Pathfinder mandates do not look like any common benchmark portfolio. We are more concentrated, less exposed to cyclicals, have better valuation metrics and stronger company fundamentals. Over the years, our allocation to the sectors, geography and cash have changed dramatically. We take a real investment stance, move capital opportunistically and, as a result, expect a more efficient return profile. We cannot guarantee better performance, but we can guarantee that we will be different. In our opinion, this is what most investors are missing in their investment structure.

When we speak with clients and prospects, we often tell them that they have three basic options for the operation of their investment portfolio. 1) “do it yourself” 2) “index” and/or 3) “hire a pro”. There are many “do it yourselfers” and if one is interested, diligent and has the time to give, this is a great way to manage a portfolio. It permits maximum flexibility and is clearly the cheapest. However, individual results can vary, and people are often not objective about evaluating themselves. The second cheapest is passive investing, which is a very valid approach. In this case, a very low-cost ETF and a long-term strategy (i.e. avoid selling in the panic times) guarantees average returns with an essentially institutional type fee. Many people also hire a pro. This unfortunately comes with mixed results. Many professional investor services rely on outsourced money management and in turn blend multiple portfolios together, essentially creating a passive portfolio with an active fee. This guarantees that the client earns subpar returns and ultimately leads to a poor client experience.

A NOTE ABOUT FIXED INCOME

We have several clients where we blend in a laddered, investment-grade fixed income portfolio to their equity and fund positions for risk mitigation and capital preservation purposes. At this point in the investment cycle, and given the all-time lows in interest rates, we do not use bonds in our portfolio as an active source of investment return. We remain allocated to short duration bonds, which are a good way to preserve capital and are less sensitive to interest rates. We also believe that credit spreads are too small to warrant investment in most corporate bonds, given the level of absolute debt in financial markets. Consequently, we also tilt the portfolio more towards government bonds. We would need to see mid-to-high single digit bond rates with moderate inflation before we would again consider it as a contributing part of our investment process. Therefore, we prefer to use fixed income as a store of nominal value preferring to focus our portfolios on companies that we believe will have increasing cash flow resulting from increasing interest rates until this environment changes in favor of fixed income.

CURRENT INVESTMENT OUTLOOK

Every year, I like to reread what I wrote the previous year and compare what I thought the coming year would bring to what actually happened. One of the nice things about writing on a regular basis is that we can track how our thought process evolves. This provides us the opportunity for reflection, which is critical for investors. Of course, I did the same thing with last year’s Current Investment Outlook section before I began to write this year’s and I was struck by how quickly inflection points can present themselves. Often when we encounter an inflection point, we must change our investment thesis but other times, doing nothing is the best course of action. Hence my comment above about how important it is to have the opportunity to reflect on our investment thesis and process.

This year, the inflection point came quickly in the form of a pandemic. We released our annual review last year on January 8, 2020 and as I read through it recently, I was struck by how consistent it was with our investment process. It contained our regular references to various economic datapoints, which showed that, while the economy was continuing to grow, it was growing at a slower rate than normal. We also believed that valuations continued to remain stretched. We noted that we had had a difficult time finding good value in stock prices that would allow us to take more positions and that low interest rates were distorting the market. This was all well and good, consistent with our investment process, and I think logically laid out but not at all how the year evolved.

I noted that above that we wrote our annual note at the beginning of January. I looked back at our weekly Investment Outlook publications and found that our first mention of the pandemic risk was in our very first Volume 10 Edition 1 released on February 7, 2020, right after our mandate reviews had been published. In reality, the first cases had already presented in North America and it was subsequently determined that, as far back as November, China and Italy had had infections. We had been thinking about this risk early and started our first edition of the Investment Outlook with a series about various disasters and their impacts on stock markets. We concluded that while there was substantial volatility during these type of markets events, that investors typically look past the event in a relatively short period of time. Sometimes that period could be measured in months and other times it was years, but the general conclusion was that if an investor had a horizon of decades, these types of events (pandemics, terrorist attacks, wars etc.), while certainly worrisome at the time, should not result in substantial change to an investment allocation as patience would ultimately be the best course of action. We also concluded that it was best to maintain investment discipline during these periods and that timing the market was very difficult. We are now faced with a very different outlook than we had one year ago so this year we break the discussion into two separate, yet equally important parts. The economy and the financial markets (which regular readers will know are not the same thing!).

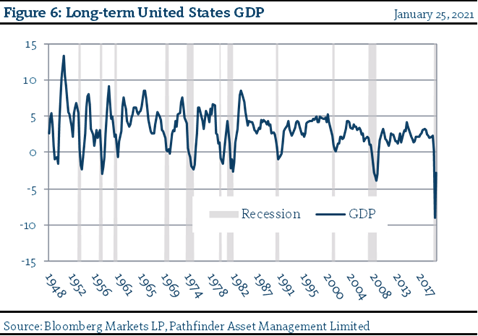

Economy: We have just gone through the highest velocity economic drop in history. While the full history has not been written, we can clearly say that there has never been as quick a decrease in the global economy during modern times. The Great Depression was worse from absolute peak to trough in terms of duration, but we have not seen the global economy essentially stop as we did this year. We also have to keep in mind that this was self-imposed. Rather than let the disease take its natural course and keep the economy open, governments around the world implemented substantial mitigation efforts (varying in severity by region), which had the effect of direct and sudden economic collapse. If legislators around the world had not added trillions of Dollars, Euros, Yen, Pounds and Yuan to their various economies, then surely developed markets would have sunk into a depression much like in the 1930’s.

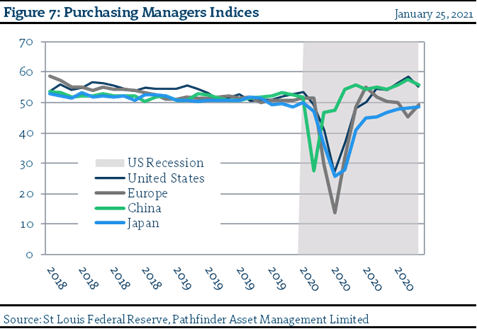

It now seems that globally we have come out the other side from an economic perspective. Most economies have somewhat stabilized and many businesses are looking past the high infection and death rates to normalcy after vaccination. Indeed, between nascent vaccination programs and an improved therapeutic approach, the initial acute public reaction to the disease seems to have moderated. Economies, other than service, travel and leisure, have rebounded and/or adjusted to what is expected to be a transitory issue. There also seems to be a belief that we can adjust medically going forward to deal with the disease, even if it becomes endemic. In short, the long-term risk appears to have abated. This is evident in several forward-looking metrics, in particular Purchasing Managers Indices, which have steadily improved over the over the course of the economic rebound and continue to reach new highs. This data is driven by expectations which are dependent on a two very critical items: 1) the ability to get the pandemic under control by the end of 2021 (i.e. the trajectory of the vaccine program) and 2) the ability of governments to continue their fiscal and monetary support. The economy is still too fragile to recover without both items working in tandem and if either comes up short, expectations will turn negative and the economy will react.

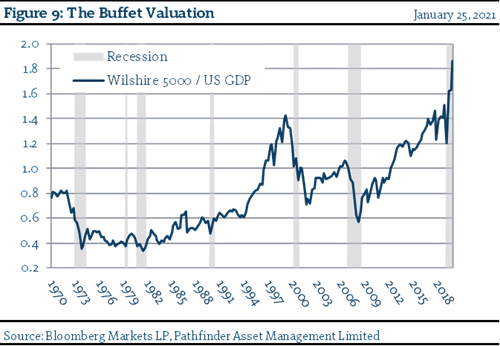

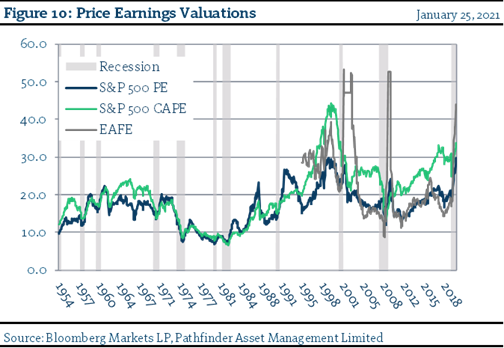

Market: While I noted on the previous page that the economy was progressing at what could be considered “rational” given its trajectory after the substantial events of the previous year, financial markets are not (our view). Please keep in mind what I noted above: The economy and the stock market are not the same thing. We have an especially excellent example of that right now. Our collective economies are as fragile as they have ever been but financial markets are has high have they have even been. Valuations are indeed stretched to the extreme.

In Pathfinder’s other mandate update reports issued so far, we have referenced the conclusion that we are in what could be described as a “bubble”. In my 25 years in this business, I have been through 2 proper bubbles, many serious financial corrections and a few bear markets. The first bubble was when I was right out of university during the dot.com era and the second, 8 years later during the commodities boom into 2007. Both periods feel very similar to what we are experiencing right now.

In both cases, I clearly remember the “back-yard party” conversations with everyone talking about how much money they were making in “the market”. Many took up day trading as a profession, spoke about having “a guy” who knew how to get them in good deals and spent a lot of time talking about how much money they were making. People that had nothing at all to do with financial markets even six months earlier seemed to have found a new calling. We are having the same conversations again, only this time it is about Bitcoin, Tesla & Gamestop on Zoom calls and WhatsApp chats, as we are not able to hang out in backyards. The most interesting thing for me about all of the “bubble talk” from the two previous bubbles was the silence afterwards. After Nasdaq lost 82% of its value in 1999, no one talked about their budding love of investing, “the guy” that has all the good deals was nowhere to be found and in the backyard parties no one showed me their account statements. To me, I think this is the point. It is precisely at the time when we are alone that we have to have the courage to buy. When we have the opportunity take positions in good quality companies with great management, we should do that…. and try to ignore the rest of the noise.

Conclusion: We will continue to look for good quality, mispriced assets that provide us fair investment opportunity. This means we will not buy “the flash”, we may have to hold cash and we may buy investments that are not exciting. We have places in our mandate mix at Pathfinder where we can take smart risk (check out our Pathfinder Funds web page). Chasing bubbles in blue chip stocks is not smart risk. It will only end up spoiling your backyard party.

CORE:100

We maintain a list of what we consider to be world class companies in all industries and across all major geographic areas. We regularly screen global stocks, based on our valuation framework, for new names that can be considered for addition to our universe of coverage. We focus on well managed, fundamentally strong firms that consistently generate and grow cash flow. We also expect strong quality management teams to reinvest that cash flow in improving their businesses. These firms have defensible advantages and ideally return any excess capital to their owners (i.e. us!!) in a rational, economic and consistent manner. The list is then filtered for qualitative factors including sector balance, general economic trends and changes in technology (even the best quality “betaMax producer” will not be a good investment!!) and we generate buy and sell targets for each company in the universe. This is what drives our portfolio investment decisions. Our thesis is that these companies should do better than the general market over the long-term and more importantly they should outperform during the regular periods of distress that we seem to have every 7-10 years. If we are buying from a list of “the best companies in the world” and buying at a discount, then the portfolios that we construct should do better on a risk-adjusted basis as well.

We try to include 100 names in the Core 100 (hence the name) but it has drifted higher as we find new additions and our investment thesis evolves to include more international companies. Generally, this is a slow-moving process that does not change significantly from year-to-year, but some evolution is healthy given global changes and the ongoing development of our investment view and process. Last year, we noted that “we expect a more material change to the universe in the coming years as we increase our coverage list to include more companies that have revenue exposure outside of North America.”. To that end, this year we removed 20 companies from the North American universe and 1 from Europe, mostly because of M&A activity and business deterioration (i.e. potential value traps). Our screening process identified 60+ companies for consideration and after reviewing each firm, we decided to add 9 to North American and 15 to the International universes. We would expect to add another 20 or so going forward to the International Universe. This is a long-term, more strategic adjustment, as we believe that over time, economic leadership will come from beyond our continent, given changes in both demographics and geopolitical circumstances. Hence, we expect the number of companies that we follow in detail to increase towards 150. Figure 11 presents our current characteristics against large exchange traded fund portfolios.

We are always looking to improve the quality of the companies that we consider for the portfolios. Each day we run the screen that identifies new companies that fit the broad parameters of what we consider to be a “good” company. The list is continually expanding and over the coming year it will be reviewed to determine if there is a potential fit for the Core 100.

National Instrument 31-103 requires registered firms to disclose information that a reasonable investor would expect to know, including any material conflicts with the firm or its representatives. Doug Johnson and/or Pathfinder Asset Management Limited are insiders of companies periodically mentioned in this report. Please visit www.paml.ca for full disclosures.

*All returns are time weighted and net of investment management fees. Performance returns from the Pathfinder Partners’ Fund and Partners’ Real Return Plus Fund are presented based on the masters series of each fund. The Pathfinder Core: Equity Portfolio and the Pathfinder Core: High Income Portfolio are live accounts. These are actual accounts owned by the Pathfinder Chairman (Equity) and client (High Income) which contain no legacy positions, cash flows or other Pathfinder investment mandates or products. Monthly inception dates for each fund and portfolio are as follows: Pathfinder Core: Equity Portfolio (January 2011), Pathfinder Core: High Income Portfolio (October 2012) Pathfinder Real Fund (April 2011), Pathfinder Real Fund (April, 2013), and Pathfinder International Fund (November 2014).

Pathfinder Asset Management Limited (PAML) and its affiliates may collectively beneficially own in excess of 10% of one or more classes of the issued and outstanding equity securities mentioned in this newsletter. This publication is intended only to convey information. It is not to be construed as an investment guide or as an offer or solicitation of an offer to buy or sell any of the securities mentioned in it. The author has taken all usual and reasonable precautions to determine that the information contained in this publication has been obtained from sources believed to be reliable and that the procedures used to summarize and analyze such information are based on approved practices and principles in the investment industry. However, the market forces underlying investment value are subject to sudden and dramatic changes and data availability varies from one moment to the next. Consequently, neither the author nor PAML can make any warranty as to the accuracy or completeness of information, analysis or views contained in this publication or their usefulness or suitability in any particular circumstance. You should not undertake any investment or portfolio assessment or other transaction on the basis of this publication, but should first consult your portfolio manager, who can assess all relevant particulars of any proposed investment or transaction. PAML and the author accept no liability of any kind whatsoever or any damages or losses incurred by you as a result of reliance upon or use of this publication.