Omicron

While the US was on vacation for Thanksgiving, global stock markets have reacted negatively to news of a new coronavirus mutation. The new variant B.1.1.529 (labeled “Omicron” by the WHO) has 32 mutations on the spike protein and 15 other mutations that may make it more infectious and better able to evade immunity.

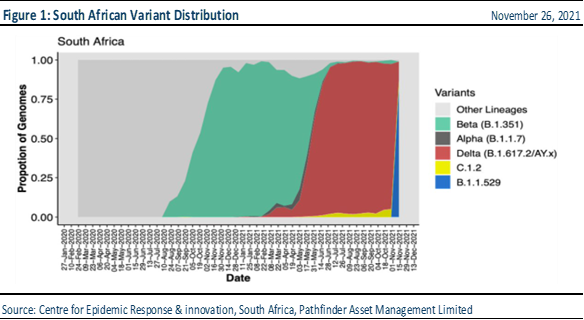

- Figure 1 presents the prevalence of the variants from genome sequencing in South Africa. As you can see, the Parental lineage (grey) had been displaced with Beta and Delta (green and red), which have now been taken over by 529 (blue). This happened quickly. It took only 2 weeks to displace Beta and Delta, both of which took about 7 weeks to displace the original lineage. One positive is that it is easily identifiable with traditional PCR testing. For this reason, it has been found early and will ultimately be easier to track and hopefully manage with mitigation measures.

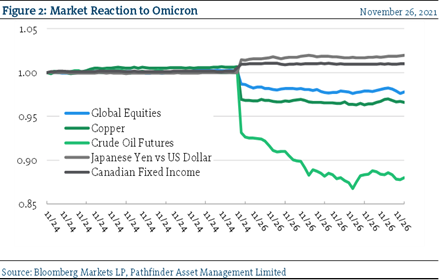

- Figure 2 presents the impact on financial assets over the holiday, and you can see, cross-asset volatility is high. Risk assets tied close to economic growth like equities, oil and copper have been impacted negatively, while safe haven assets like fixed income and certain currency crosses have provided cover. This is how one would expect the market to react and while it is ultimately negative for equity holders in the short-term, it is nice to see that the market is reacting as expected (for a change).

“This means that” from the financial perspective, while the media headlines are alarming (they are designed to be that way to get you to watch), we are still at all-time highs in multiple asset classes. Some repricing would be normal and, in fact, should be expected. In health terms, this is worrying but we will not know if the mutation is more infectious and/or more lethal for several weeks. We have been here before with variants that were thought to be more dangerous and fell away (Gamma, Epsilon and Lambda, for example). Thus, we should remain clear eyed and measured in our analysis, as opposed to letting our emotions (fear and greed) take hold.

National Instrument 31-103 requires registered firms to disclose information that a reasonable investor would expect to know, including any material conflicts with the firm or its representatives. Doug Johnson and/or Pathfinder Asset Management Limited are an insider of companies periodically mentioned in this report. Please visit www.paml.ca for full disclosures.

*All returns are time weighted and net of investment management fees. Returns from the Pathfinder Partners’ Fund and Partners’ Real Return Plus Fund are presented based on the masters series of each fund. The Pathfinder Core: Equity Portfolio and The Pathfinder Core: High Income Portfolio are live accounts. These are actual accounts owned by the Pathfinder Chairman (Equity) and client (High Income) which contain no legacy positions, cash flows or other Pathfinder investment mandates or products. Monthly inception dates for each fund and portfolio are as follows: Pathfinder Core: Equity Portfolio (January 2011), Pathfinder Core: High Income Portfolio (October 2012) Partners’ Fund (April 2011), Partners’ Real Return Plus Fund (April, 2013), and Partners’ Core Plus Fund (November 2014).

Pathfinder Asset Management Limited (PAML) and its affiliates may collectively beneficially own in excess of 10% of one or more classes of the issued and outstanding equity securities mentioned in this newsletter. This publication is intended only to convey information. It is not to be construed as an investment guide or as an offer or solicitation of an offer to buy or sell any of the securities mentioned in it. The author has taken all usual and reasonable precautions to determine that the information contained in this publication has been obtained from sources believed to be reliable and that the procedures used to summarize and analyze such information are based on approved practices and principles in the investment industry. However, the market forces underlying investment value are subject to sudden and dramatic changes and data availability varies from one moment to the next. Consequently, neither the author nor PAML can make any warranty as to the accuracy or completeness of information, analysis or views contained in this publication or their usefulness or suitability in any particular circumstance. You should not undertake any investment or portfolio assessment or other transaction on the basis of this publication, but should first consult your portfolio manager, who can assess all relevant particulars of any proposed investment or transaction. PAML and the author accept no liability of any kind whatsoever or any damages or losses incurred by you as a result of reliance upon or use of this publication.