Pathfinder International Fund – ASML Holding NV

Since the end of February, we have been focused on writing about “macro”. Macro refers to large broad themes, thesis or data points that describe something in aggregate. For example, last week we wrote about the US Bureau of Labor Payroll Report and the debate around how its results could predict the trajectory of the economy. This is different than “micro” which is more about a specific situation. Job layoffs at a single company like JC Penny Co (JCPNQ:US) or Marriott International Inc (MAR:US) is a micro event. While the macro situation impacts all companies, it is investments in individual businesses (i.e. the micro) that actually make up the portfolios at Pathfinder. Macro is stubbornly difficult to predict on a consistent basis, but we all pay attention to it as part of the investment process. However, focusing on a specific micro situation (i.e. a company that we can invest in) can provide an opportunity for us to get an “edge” either through better information or adopting an investment thesis that other investors do not value in the same way.

The current macro environment (pandemic, trade wars, social unrest) has created extreme share price volatility; however, by focusing on the micro we have found that not all companies are negatively impacted by these events. For example, there are companies whose business model have made them effectively recession proof and others who actually see accelerated demand for their products as a result of the pandemic. We believe particular disconnects between share price and fundamentals created the opportunity to invest in good companies at very attractive prices. Over the coming weeks, we will provide an example of this from each of our portfolios

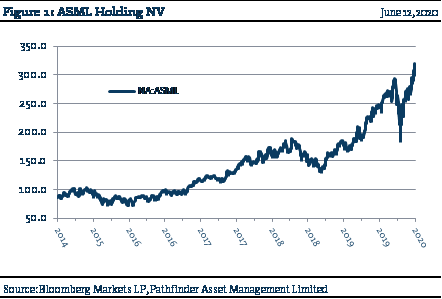

- ASML Holding NV (ASML:NA), a company based in Netherlands, develops and manufactures equipment used in the process of producing semiconductors. With tens of billions of dollars invested in R&D over more than a decade, ASML has become the only company in the world that can supply advanced lithography machines to manufacture the world’s most advanced semiconductors (single digit nanometer chips). Those chips will be used to power the next generation of cellphones, computers, datacenters, AI and IoT. We believe that global digitalization is inevitable and that COVID-19 accelerated the trend. ASML sells to essentially all of the chip makers and has had no impact to orders or revenue from the current recession.

- The stock has been expensive and consequently before the pandemic we were only able to own an underweight position in the fund. We took the volatility in March as an opportunity to triple our position.

“This means that” we now own a full position in ASML and will hold until our investment thesis is achieved or the stock passes through the upper end of our valuation range and becomes too expensive.

National Instrument 31-103 requires registered firms to disclose information that a reasonable investor would expect to know, including any material conflicts with the firm or its representatives. Doug Johnson and/or Pathfinder Asset Management Limited are an insider of companies periodically mentioned in this report. Please visit www.paml.ca for full disclosures.

*All returns are time weighted and net of investment management fees. Returns from the Pathfinder Partners’ Fund and Pathfinder Real Fund are presented based on the masters series of each fund. The Pathfinder North American Equity Portfolio and The Pathfinder North American Income Portfolio are live accounts. These are actual accounts owned by the Pathfinder Chairman (Equity) and client (High Income) which contain no legacy positions, cash flows or other Pathfinder investment mandates or products. Monthly inception dates for each fund and portfolio are as follows: Pathfinder North American Equity Portfolio (January 2011), Pathfinder North American High-Income Portfolio (October 2012) Pathfinder Partners’ Fund (April 2011), Pathfinder Real Fund (April, 2013), and Pathfinder International Fund (November 2014).

Pathfinder Asset Management Limited (PAML) and its affiliates may collectively beneficially own in excess of 10% of one or more classes of the issued and outstanding equity securities mentioned in this newsletter. This publication is intended only to convey information. It is not to be construed as an investment guide or as an offer or solicitation of an offer to buy or sell any of the securities mentioned in it. The author has taken all usual and reasonable precautions to determine that the information contained in this publication has been obtained from sources believed to be reliable and that the procedures used to summarize and analyze such information are based on approved practices and principles in the investment industry. However, the market forces underlying investment value are subject to sudden and dramatic changes and data availability varies from one moment to the next. Consequently, neither the author nor PAML can make any warranty as to the accuracy or completeness of information, analysis or views contained in this publication or their usefulness or suitability in any particular circumstance. You should not undertake any investment or portfolio assessment or other transaction on the basis of this publication, but should first consult your portfolio manager, who can assess all relevant particulars of any proposed investment or transaction. PAML and the author accept no liability of any kind whatsoever or any damages or losses incurred by you as a result of reliance upon or use of this publication.