Pathfinder Small Cap Quarterly Report

MARCH 28, 2024

The Pathfinder Small Cap mandates investment in high-torque, early-stage companies that have the potential to generate superior returns.

Pathfinder Partners’ Fund

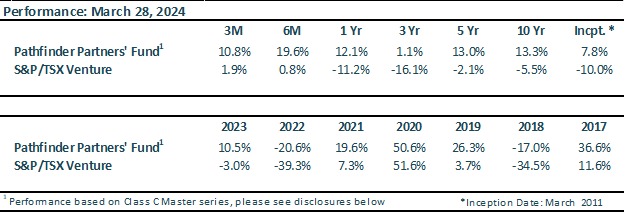

The Partners’ Fund had a net return of +10.8% in the first quarter of 2024. This compares to the TSX Venture Exchange return of +1.9%. Our annualized 10-year return is +13.3% compared to the TSX Venture Exchange’s return of -5.5% over the same period. The table below provides a performance summary.

Our top contributors for the quarter were Vitalhub Corp. (TSX:VHI) which added +3.2%, Mereo Biopharma Group (NASDAQ:MREO) which added +2.1%, and Montage Gold Corp. (TSXv:MAU) adding +1.9%. Our main detractors were Leap Therapeutics (NASDAQ:LPTX) at -1.3% and Eupraxia Pharmaceuticals (TSXv:EPRX) at -0.8%.

The positive momentum we noted in the last quarterly has continued and we are starting to see a glimpse of the “coiled-spring” effect we’ve been mentioning – where small caps experience torquey returns as the macro environment turns bullish. Optimism regarding the economy has led small caps to outperform their larger counterparts. Given the market’s tendency to swiftly change, building positions in “sleepy” cash-generating companies can be a great way to take advantage of the coiled spring before it launches.

Our biotech thesis continues to unfold – our proxy indicator for the biotech space is up over 40% since its lows in late October. We still see ample room for growth and anticipate heightened merger and acquisition activity, especially as larger biotechs look to take advantage of smaller players. A key criteria that we look for in our biotech investments are companies that can utilize their cash efficiently. Those companies that distinguish themselves with drugs qualifying for accelerated approvals, equivalence pathways like 510(k) or 505(2)b, or orphan designation in the rare disease space can get a bigger bang for their buck. This is an extremely exciting time for the sector. Novel technologies are driving hyper-targeted therapeutics that surpass current standards of care, including the groundbreaking FDA approval of Gene editing therapies via CRISPR, perhaps the most exciting development in decades.

Conversely, the renewables and clean technology sector continues to underperform, with our renewables proxy declining by 42% over the past twelve months. Excessive capital inflow chasing low-quality business opportunities has been a primary contributor to this downturn. However, a positive outcome of this fallout is that only the strongest operators are poised to survive, and these select few should thrive as the market’s demand for profitable green technology companies remains robust.

With the above in mind, the Partners’ Fund has taken steps to rebalance our portfolio by managing our position sizes in the biotech space while also adding new positions in discounted opportunities. To de-risk our green technology investments, we trend towards companies with successful pilot plants that are in the process of scaling to commercial testing with the assistance of industry partners. Char Technologies (TSXv:YES), which we’ve extensively discussed previously, serves as an exemplary case in point.

In general, we’ve begun to witness an uptake in deal flow within the private and small-cap public markets. Over the past few years, new listings have markedly slowed, with many companies opting to remain private due to doubts regarding proper valuation by the market. Consequently, new listings in the small cap space tended to exhibit weaker fundamentals, i.e. those with stronger businesses would rather stay private, whereas weaker (or simply less-well funded) businesses needed to go-public to continue operations.

Encouragingly, we’re now seeing the return of listings and improved funding streams into the small-cap arena. For instance, a few companies we’ve followed have struggled to raise even a few million dollars up until recently but have now closed oversubscribed rounds. The risk appetite and optimism from the US is gradually permeating into the Canadian small cap market, and we are looking forward to what the rest of the year holds.

Pathfinder Resource Fund

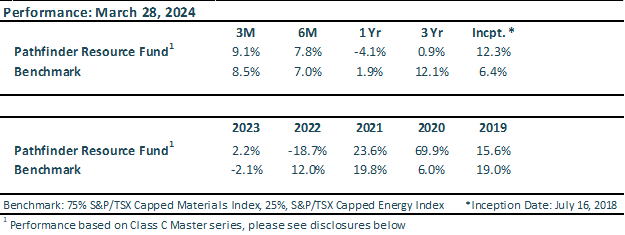

The Resource Fund had a net return of +9.1% in the first quarter of 2024. This compares to the benchmark which had a return of +8.5%. Since inception (July 16, 2018), the Resource Fund has returned +12.3% annualized versus the benchmark’s return of +6.4%. The table below provides a performance summary.

Our top contributors for the quarter were Montage Gold (TSXv:MAU) which contributed +3.9% to gross returns, Orogen Royalties Inc. (TSXv:OGN) which added +3.6%, and Calibre Mining Corp. (TSX:CXB) which added +1.2%. The main detractors were Archer Exploration Corp. (CSE:RCHR) at -1.0% and Pan Global Resources Inc. (TSXv:PGZ) at -0.9%.

Previously, we mentioned the outperformance of precious metals, a trend that has continued into the first quarter. We also noted the historical pattern where producers and developers lead the way as prices rise followed by the junior exploration companies. We have observed this trend in our core holdings and while the juniors have lagged, we continue to build out a pipeline of discovery driven companies that offer additional upside leverage.

Last quarter, we highlighted two of our favourite gold companies: one producer and one developer. Both have benefited from a rise in the price of gold and positive fundamental developments. Calibre Mining Corp. (TSX:CXB), our producer, acquired Marathon Gold’s Valentine Mine project, and is set to boost gold production to 500 koz/year upon completion. Calibre’s success lies in organic growth through drilling and discovery. Since acquiring their Nicaraguan assets in 2019, the company has consistently increased resources net of depletion through production, growing reserves by 398%. Recently, they tripled their drill budget to over 100,000m this year, driven by the compelling results from the Panteon VTEM Corridor at the Limon Complex. The VTEM corridor is a multi-kilometre long target that is analogous to Panteon Norte and shows potential for a string of pearls deposit along the corridor. In Newfoundland, they are focused on bringing Valentine into production by the first half of 2025, and implementing the same successful growth strategy. Not only has ore control drilling increased mineral reserves by 12%, but resource expansion drilling also identified the near mine “Frank Zone” suggesting the potential for another new deposit. We believe Calibre is well-positioned to capitalize on a strong gold environment through resource expansion and solid production, while their ongoing 100,000m drill program provides leverage to a discovery driven market. We are excited about the next step change in Calibre’s journey as they de-risk the Valentine gold project on their way to 500 koz of gold production establishing them as a quality mid-tier producer.

Following up on Montage Gold Corp. (TSXv.MAU), we mentioned the company’s acquisition of Gbongogo, which many initially overlooked. However, we saw this acquisition as a positive boost to the project’s economics. The market has now taken notice, particularly following the Lundin Family’s endorsement and backing. Earlier this year, the Lundin Family Trusts increased their stake to 19.9% in Montage with a goal to create a multi-asset mid-tier gold producer focused on Africa. The Lundin Group was founded over 50 years ago and have been successful in finding and building mines throughout the years. The Lundin’s backing of Montage has bolstered their management team through the additions of seasoned mine builders with proven track records. We believe the company is primed to advance from developer to producer. With a solid valuation backstop via the Koné Gold project and now the expertise and access to capital to see this through to production, Montage has decidedly outperformed (+138%) its peer group of developers (average +41%) over the last six months. As the company progresses towards production, we anticipate the potential for another re-rate, while also acknowledging the presence of over twenty exploration targets offering the potential for new satellite deposits.

While precious metals have been at the forefront of the recent commodity rally, we would like to emphasize the diversification of our portfolio. We remain focused on quality companies that have compelling catalysts and the ability to finance and advance projects. We believe our supply driven thesis is beginning to materialize as global economies ramp up, increasing demand for raw materials and a potential multi-year cycle.

National Instrument 31-103 requires registered firms to disclose information that a reasonable investor would expect to know, including any material conflicts with the firm or its representatives. Doug Johnson and/or Pathfinder Asset Management Limited are an insider of companies periodically mentioned in this report. Please visit www.paml.ca for full disclosures.

* All returns are time weighted and net of investment management fees. Returns from the Pathfinder Partners’ Fund are presented based on the Class C Master series except prior to its inception in July 2011 when the Class A Master series was used. Inception returns include the 10 months from inception in March 2011. Returns greater than one year are annualized. Returns from the Pathfinder Resource Fund are presented based on the Class C Master series since its inception in July 16, 2018. The S&P/TSX Venture Composite Index (C$), the S&P/TSX Venture Composite Index, the S&P/TSX Capped Materials Index and the S&P/TSX Capped Energy Index provide general information and should not be interpreted as a benchmark for your own portfolio return. Further details of the Partners’ Fund are available on request.

Changes in Leverage. We are increasing the asset ceiling to 2.0 times the market value of equity for Pathfinder International Fund and Pathfinder Conviction Fund to be consistent with Pathfinder Partners’ Fund and Pathfinder Resource Fund.

Pathfinder Asset Management Limited (PAML) and its affiliates may collectively beneficially own in excess of 10% of one or more classes of the issued and outstanding equity securities mentioned in this newsletter. This publication is intended only to convey information. It is not to be construed as an investment guide or as an offer or solicitation of an offer to buy or sell any of the securities mentioned in it. The author has taken all usual and reasonable precautions to determine that the information contained in this publication has been obtained from sources believed to be reliable and that the procedures used to summarize and analyze such information are based on approved practices and principles in the investment industry. However, the market forces underlying investment value are subject to sudden and dramatic changes and data availability varies from one moment to the next. Consequently, neither the author nor PAML can make any warranty as to the accuracy or completeness of information, analysis or views contained in this publication or their usefulness or suitability in any particular circumstance. You should not undertake any investment or portfolio assessment or other transaction on the basis of this publication, but should first consult your portfolio manager, who can assess all relevant particulars of any proposed investment or transaction. PAML and the author accept no liability of any kind whatsoever or any damages or losses incurred by you as a result of reliance upon or use of this publication.