Portfolio Diversification and Commodities

A major part of the investment management process for clients at Pathfinder is managing exposures to different types of investment portfolios and mandates. Our firm-wide investment thesis is that risk saved by managing assets in a conservative part of the portfolio can be invested in different, more aggressive assets. Clients will know that we use a combination of large capitalization equities, investment grade fixed income and cash to provide the “risk-reduced” part of the portfolio and the Pathfinder Funds to provide the “risk-taking” part of the portfolio. A very important part of this strategy is the lower correlation between the two broad buckets (Core and Funds) but also the lower/negative correlation of the strategies within each of those two buckets: Core (i.e. the difference between return profiles of stocks, bonds and cash) and Pathfinder Funds (i.e. the difference between Canadian Small Cap, International, Resources and Inflation).

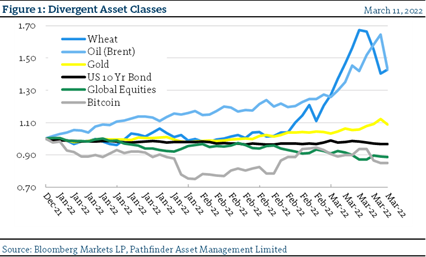

In our recent Daily Trade Desk Meetings and during Investment Committee we have identified both the divergence of commodities from other markets, but also differences within the commodities complex itself. Figure 1 presents how different assets have performed (i.e. diverged) over the last several weeks. Two simple examples of this fundamental difference that we have discussed this week are potash and neon. Both commodities are produced in either Russia, Ukraine & Belarus, and both are critical to the globe: potash to grow food, and neon as a critical part of semi-conductor production. Canada has a significant amount of potash, which we believe can be a substitute; however, 50% of the world’s neon production and 90% of U.S. semiconductor-grade neon comes from 2 companies in the Ukraine that create it as a by-product from Russian steel making. It could take 2 years to build a substitute. We identify three broad areas that we have debated internally and would like to provide more commentary on.

- Grains: Soybeans, wheat, corn, rice and fertilizers. While energy grabs the headlines, these are the items that keep the world fed and food prices can result in global unrest, so this area is critical.

- Energy: Natural Gas, Crude, Nuclear, Hydrogen. Wars have started over this for 100 years.

- Metals: Both from the precious metals side, which is more of an inflation discussion, but also from the critical use standpoint. Steel, copper and battery metals (an interesting intersection with power section noted above).

“This means that” for the next several Investment Outlooks, we will dive into the three different commodities sectors above to provide some discussion of how the each of these broad sectors are evolving. The interplay within the sectors is very noteworthy, especially when the current geopolitical situation is overlayed on to the existing pandemic recovery, supply shortage and monetary inflation back drops.

National Instrument 31-103 requires registered firms to disclose information that a reasonable investor would expect to know, including any material conflicts with the firm or its representatives. Doug Johnson and/or Pathfinder Asset Management Limited are an insider of companies periodically mentioned in this report. Please visit www.paml.ca for full disclosures.

*All returns are time weighted and net of investment management fees. Returns from the Pathfinder Partners’ Fund and Partners’ Real Return Plus Fund are presented based on the masters series of each fund. The Pathfinder Core: Equity Portfolio and The Pathfinder Core: High Income Portfolio are live accounts. These are actual accounts owned by the Pathfinder Chairman (Equity) and client (High Income) which contain no legacy positions, cash flows or other Pathfinder investment mandates or products. Monthly inception dates for each fund and portfolio are as follows: Pathfinder Core: Equity Portfolio (January 2011), Pathfinder Core: High Income Portfolio (October 2012) Partners’ Fund (April 2011), Partners’ Real Return Plus Fund (April, 2013), and Partners’ Core Plus Fund (November 2014).

Pathfinder Asset Management Limited (PAML) and its affiliates may collectively beneficially own in excess of 10% of one or more classes of the issued and outstanding equity securities mentioned in this newsletter. This publication is intended only to convey information. It is not to be construed as an investment guide or as an offer or solicitation of an offer to buy or sell any of the securities mentioned in it. The author has taken all usual and reasonable precautions to determine that the information contained in this publication has been obtained from sources believed to be reliable and that the procedures used to summarize and analyze such information are based on approved practices and principles in the investment industry. However, the market forces underlying investment value are subject to sudden and dramatic changes and data availability varies from one moment to the next. Consequently, neither the author nor PAML can make any warranty as to the accuracy or completeness of information, analysis or views contained in this publication or their usefulness or suitability in any particular circumstance. You should not undertake any investment or portfolio assessment or other transaction on the basis of this publication, but should first consult your portfolio manager, who can assess all relevant particulars of any proposed investment or transaction. PAML and the author accept no liability of any kind whatsoever or any damages or losses incurred by you as a result of reliance upon or use of this publication.