Q2 2020 Earnings Season

Since the end of January investors have been focused on macro analysis and geopolitical events as they relate to the pandemic. This topic is top of mind and seems to take up much of the media focus. However, at Pathfinder we spend most of our time discussing and analyzing the businesses that we own. We view the “stocks” in our portfolios and funds as fractional ownership in operating business that happen to be offered for purchase or sale on a market. Regular readers of our note will recognize the earnings tables below. Every 3 months companies report their financial results and as analysts we go into “earnings season”, which we are in the middle of today. Earnings season for us is a combination of a few things. First and foremost, the companies that we own release financial statements, investor presentations and supplementary data. They also hold conference calls. Over the course of two months as the companies release the news, we go through the financial data, update our financial models, review the presentations and listen to the conference calls. This helps us determine the evolution of our investment thesis or potential identify a problem that needs to be further researched. The tables below are aggregates of data for all companies in the US and Canada and can help us with this insight.

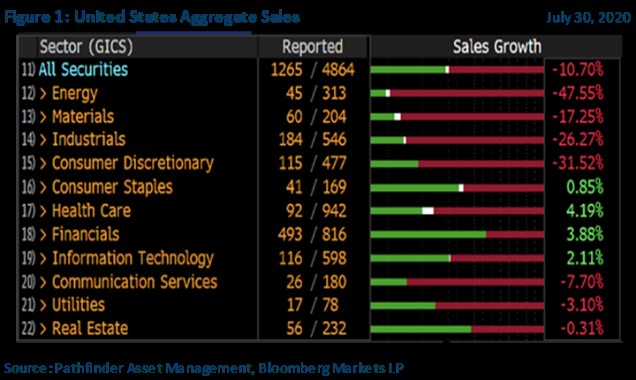

- In the United States, 26% of companies have reported and on a broad basis it looks like total revenue is tracking down an historic -10% over the quarter. This does make sense because yesterday the US released its Q2 GDP data and it was also down 9.5% for the quarter. As you can see the cyclical components of the economy (mining, energy, industry, and discretionary consumption) have really suffered while only basic items and healthcare have been able to post growth. This also makes sense given the situation and activity.

- In Canada, earnings season is still just getting going with only 11% of companies reporting but similar themes as down south are visible. It seems that the results are a little more acute, but because we still have 90% of companies to report, we should wait before we make any concrete conclusions.

“This means that” the results have come in as we had previously expected. We will update again at the end of August but given the high frequency and caseload data has been in the US, we expect the economic difficultly to continue.

Michael Rudd, CFA | President, CEO & Portfolio Manager

National Instrument 31-103 requires registered firms to disclose information that a reasonable investor would expect to know, including any material conflicts with the firm or its representatives. Doug Johnson and/or Pathfinder Asset Management Limited are an insider of companies periodically mentioned in this report. Please visit www.paml.ca for full disclosures.

*All returns are time weighted and net of investment management fees. Returns from the Pathfinder Partners’ Fund and Partners’ Real Return Plus Fund are presented based on the masters series of each fund. The Pathfinder Core: Equity Portfolio and The Pathfinder Core: High Income Portfolio are live accounts. These are actual accounts owned by the Pathfinder Chairman (Equity) and client (High Income) which contain no legacy positions, cash flows or other Pathfinder investment mandates or products. Monthly inception dates for each fund and portfolio are as follows: Pathfinder Core: Equity Portfolio (January 2011), Pathfinder Core: High Income Portfolio (October 2012) Partners’ Fund (April 2011), Partners’ Real Return Plus Fund (April, 2013), and Partners’ Core Plus Fund (November 2014).

Pathfinder Asset Management Limited (PAML) and its affiliates may collectively beneficially own in excess of 10% of one or more classes of the issued and outstanding equity securities mentioned in this newsletter. This publication is intended only to convey information. It is not to be construed as an investment guide or as an offer or solicitation of an offer to buy or sell any of the securities mentioned in it. The author has taken all usual and reasonable precautions to determine that the information contained in this publication has been obtained from sources believed to be reliable and that the procedures used to summarize and analyze such information are based on approved practices and principles in the investment industry. However, the market forces underlying investment value are subject to sudden and dramatic changes and data availability varies from one moment to the next. Consequently, neither the author nor PAML can make any warranty as to the accuracy or completeness of information, analysis or views contained in this publication or their usefulness or suitability in any particular circumstance. You should not undertake any investment or portfolio assessment or other transaction on the basis of this publication, but should first consult your portfolio manager, who can assess all relevant particulars of any proposed investment or transaction. PAML and the author accept no liability of any kind whatsoever or any damages or losses incurred by you as a result of reliance upon or use of this publication.