Pathfinder Small Cap Quarterly Report

June 30, 2020

The Pathfinder Small Cap mandates invest in high-torque, early-stage companies that have the potential to generate superior returns.

Pathfinder Partners’ Fund

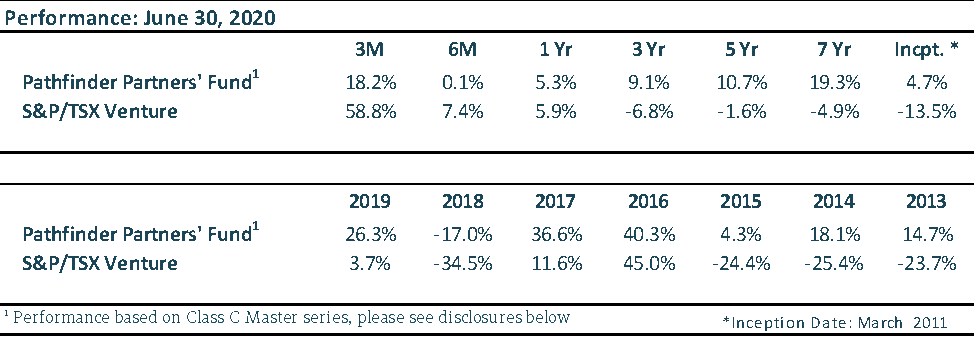

The Partners’ Fund had a net return of 0.1% in the first half of 2020. This compares to the TSX Venture Exchange which rose by 7.4%. Our annualized 7-year return is 19.3% compared to the TSX Venture Exchange’s return of -4.9% per year over the same period. The table below provides a performance summary:

During the quarter, our top performers were Exro Technologies (CSE:XRO), AnalytixInsight Inc (TSXv:ALY), and Altius Minerals Corp (TSX:ALS). They added 3.4%, 2.5%, and 2.3% to gross portfolio returns, respectively. Our largest detractor was Currency Exchange International (TSX:CXI) which brought a 1.2% loss.

Exro has been active this year signing partnerships to provide technology proof-of-concept in a variety of applications and benefited from market exuberance related to ‘Clean Tech’ and the global clean energy revolution. As we have written about previously, we are in the midst of a major trend away from fossil fuels as technology advancements have combined with societal pressure to advance environmental and sustainability initiatives. We see this trend continuing for multiple years.

The stock price of AnalytixInsight had an aggressive decline in March but has recently recovered as the company advanced the business plan of Marketwall, its 49%-owned subsidiary. Marketwall is a fintech company that is developing an online stock-trading business in partnership with Intesa Sanpaolo, the largest bank in Italy. They have recently applied to become a European online financial broker. We believe this is a timely development, as retail trading activity has surged over the last few months and Europe has lagged the US in development of discount trading platforms.

We purchased the vast majority of our Altius position during March when the market was in turmoil. This holding has benefited from a general recovery in markets; however, the original rationale for purchase involved adding market exposure that had downside protection due to its discounted valuation and resilient business model which is exposed to royalty revenue. We are fortunate that markets recovered and we didn’t have to test our ‘downside protection’ thesis with Altius. That being said, memories of the extreme fear and uncertainty that gripped the world in March already seem to be fading. We had no way of knowing there would be such a dramatic recovery in the market and our Altius purchase took into consideration a wide range of potential outcomes.

Currency Exchange International has been hit hard by the global pandemic. Their business is highly correlated to international travel volume. They provide physical banknotes to institutional customers for use in their foreign exchange operations and operate retail FX locations. Volumes have declined dramatically, and retail locations have been closed which will cause CXI to lose money in 2020 after many years of profitable operations. Fortunately, the company has a strong balance sheet and is poised to survive and gain market share throughout this disruption. While the next 12 months will be difficult, we continue to hold our position and believe that the storm will eventually subside, and Currency Exchange will emerge from this crisis stronger.

Due to the strong venture market this quarter, we have seen acceleration in go-public activity. Two companies went public and one company announced a go-public transaction in recent months. Both companies that went public are in the health care space. Neupath Health Inc (TSXv:NPTH) is Canada’s largest provider of chronic pain services and operates clinics across Ontario. Perimeter Medical Imaging AI Inc (TSXv:PINK) is a medical device company that has an FDA cleared imaging system which allows clinicians to detect in real-time if cancer has been left behind in a surgery. This reduces the need for repeat surgeries and re-excisions. Our third company, Askott Entertainment Inc (Private) is going public through a 50/50 merger with FansUnite Entertainment Inc (CSE:FANS). Askott and Fansunite are online gaming/gambling companies focused on sports betting, esports (video game) wagering, and casino games.

We have taken advantage of the recent rebound in the stock market to sell positions where we have lower conviction and are confident in the current portfolio composition. We believe the fund has potential to generate strong returns on a go-forward basis. Thank you for your enduring trust and support!

Pathfinder Resource Fund

After a difficult first quarter, the Resource Fund rebounded 43.6% in the second quarter for a net return of 18.4% in the first half of 2020. This compares to the benchmark decline of 3.3%. Since inception (July 16, 2018), the Resource Fund has returned 10.0% annualized versus the benchmark annualized return of -4.1% per year. The benchmark consists of 75% of the daily return of the S&P/TSX Capped Materials Index and 25% of the daily return of the S&P/TSX Capped Energy Index.

During the quarter, a wide range of investments contributed to returns due to a hot junior mining market, particularly in gold. Our top three performers during the quarter were GR Silver Mining Ltd (TSXv:GRSL), Calibre Mining Corp (TSXv:CXB) and Altius Minerals Corp (TSX:ALS), adding 4.1%, 3.4%, and 3.1% to gross returns respectively. We had 18 companies contribute 1% or more to the portfolio during the quarter with zero detracting 1% from the portfolio.

Gold is typically seen as a safe haven metal and has benefitted from anticipated inflationary pressures from the massive stimulus packages implemented to prop up economies during the ongoing pandemic. These stronger gold prices have led to a repositioning of asset allocation by investors into commodities. This is reflected in the amount of equity capital raised on the TSX and TSXV, up 55% to a total of $2.4B YTD as of June 2020. Much of the initial interest has been directed towards producers and mid-tier development companies; however, quality junior exploration companies such as GR Silver are starting to see the money trickle down to them as well. We have been following and investing in GRSL over the last couple years as part of our strategy to own high quality names in anticipation of improving market conditions.

GRSL is a Mexico-focused (mining is considered an essential service in Mexico) company engaged in gold and silver exploration at their flagship past producer Plomosas mine. What separates GRSL from other junior explorers is the Company’s ability to strategically select and acquire “company making” projects at deep discounts. An example of this is their recent acquisition of the Plomosas silver project which has at least $8M of exploration work, excellent infrastructure, and a historic resource. This property was acquired for ~$3M worth of equity and demonstrates management’s ability to allocate capital efficiently towards adding value to the company rather than detracting from it. GRSL is well positioned with a district scale land package, three past producing mines and significant exploration upside to benefit from the current rally in the precious metals sector.

In terms of our current strategy, we are trying to maximize the return in our precious metal investments during this strong run-up in the gold price while building a pipeline of future investment ideas in copper and battery metals. As gold companies become overvalued and/or purchased through M&A activity, we hope to redeploy our profits in sectors with a favorable demand profile and supply constraints in commodities such as copper and battery metals.

With regards to copper, we see no change to our long-term supply driven thesis other than that it has been pushed back due to COVID-19 challenges. We previously forecasted a deficit in 2020 but because of the economic downturn we now expect a surplus. The International Wrought Copper Council (IWCC) estimates global copper production is at ~23Mt and while demand is projected at 22.6Mt in 2020. China is the world’s largest importer and we have seen an increase in copper price in the past month as their economy has showed signs of recovery. During the pandemic, stockpiles began to rise but the increased activity from China has brought inventories back to pre-pandemic levels.

Overall, our long-term outlook remains unchanged. As electrification increases across global economies, we expect an increase in demand yet tightening supply due to lack of discoveries (20 years required to advance a project from discovery to production) which will affect the long-term fundamentals and provide a positive outlook for the copper commodity price going forward. For battery metals, we see an even stronger demand picture than copper, but fewer supply constraints (we believe higher prices will quickly incent new production). Junior mining companies focused on battery metals are currently out-of-favor, but we believe this sector will heat up in the coming years in a similar fashion to today’s enthusiasm for junior gold companies.

National Instrument 31-103 requires registered firms to disclose information that a reasonable investor would expect to know, including any material conflicts with the firm or its representatives. Doug Johnson and/or Pathfinder Asset Management Limited are an insider of companies periodically mentioned in this report. Please visit www.paml.ca for disclosures.

* All returns are time weighted and net of investment management fees. Returns from the Pathfinder Partners’ Fund are presented based on the Class C Master series except prior to its inception in July 2011 when the Class A Master series was used. Inception returns include the 10 months from inception in March 2011. Returns greater than one year are annualized. Returns from the Pathfinder Resource Fund are presented based on the Class C Master series since its inception in July 16, 2018. The S&P/TSX Venture Composite Index (C$), the S&P/TSX Venture Composite Index, the S&P/TSX Capped Materials Index and the S&P/TSX Capped Energy Index provide general information and should not be interpreted as a benchmark for your own portfolio return. Further details of the Partners’ Fund are available on request.

Pathfinder Asset Management Limited (PAML) and its affiliates may collectively beneficially own in excess of 10% of one or more classes of the issued and outstanding equity securities mentioned in this newsletter. This publication is intended only to convey information. It is not to be construed as an investment guide or as an offer or solicitation of an offer to buy or sell any of the securities mentioned in it. The author is an employee of PAML, but the data selection, analysis and views expressed herein are solely those of the author and not those of PAML. The author has taken all usual and reasonable precautions to determine that the information contained in this publication has been obtained from sources believed to be reliable and that the procedures used to summarize and analyze such information are based on approved practices and principles in the investment industry. However, the market forces underlying investment value are subject to sudden and dramatic changes and data availability varies from one moment to the next. Consequently, neither the author nor PAML can make any warranty as to the accuracy or completeness of information, analysis or views contained in this publication or their usefulness or suitability in any particular circumstance. You should not undertake any investment or portfolio assessment or other transaction on the basis of this publication, but should first consult your portfolio manager, who can assess all relevant particulars of any proposed investment or transaction. PAML and the author accept no liability of any kind whatsoever or any damages or losses incurred by you as a result of reliance upon or use of this publication.