Real Fund Semi-Annual Report

December 31, 2019

The Real Fund invests in assets exhibiting specific qualities that allow for long-term growth beyond inflation.

PERFORMANCE

For the year ending December 31st, 2019, our fund delivered a net return of 15.3%; inflation was 1.8% as measured by our custom cost of living index; and 2.2% as measured by the Canadian Consumer Price Index (CPI).

Global equity markets were strong in 2019 surprising many who carried heightened pessimism into the year. A healthy amount of emotional control was required to think rationally through the volatility and negativity rampant at the end of 2018. By focusing on our reason, we maintained and added to our investments during this time. This was a driving factor to the return we incurred in 2019.

While we are pleased with our return, it lagged the headline TSX Composite Total Return Index of 22.9%. Headline indices measure the return of large companies, which have had a phenomenal run the last 5+ years. However, smaller companies have not seen the same rise in value: the TSX SmallCap Index has returned -2.6% cumulatively over the last 3 years! This is significantly behind the large-cap TSX return of 22.2% over the same time period.

Given this discrepancy and the value we see in small caps, the Real Fund has been shifting to smaller companies and now has a 55% weight in companies <$3.0B in size. Small caps lagged again this year driving our fund to lag the large-cap TSX; however, we expect this could reverse in the future. Being benchmark-agnostic allows us to invest where we see long-term value, regardless of what happens in the short-term.

ASSET ALLOCATION

Companies: 78% Weight

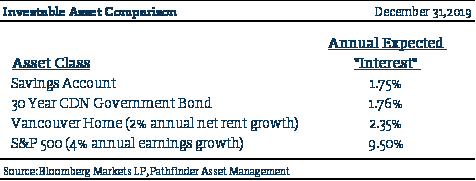

No change to our long-held view that businesses are undervalued relative to other asset classes like fixed income, real estate, and infrastructure: our fund remains substantially weighted to publicly traded businesses

- Boyd Group Services Inc. (+79% in 2019) conducts collision auto repair across North America. When a car accident occurs, auto insurance companies have shown a growing preference in dealing with Boyd for repair. This has driven increasing business for Boyd who has now delivered a decade of incredible organic and acquisitive growth.

- JP Morgan Chase & Co. (+45% in 2019) and Bank of America Corp. (+43% in 2019) are two American banks at the forefront of technological advancement. Enhanced digital banking has been attracting clients from smaller regional banks while also reducing JPM/BAC’s reliance on brick & mortar space. When combined with deregulation and a steady credit environment, we believe the outlook for both banks remains bright.

- Stella Jones Inc. (-4% in 2019) is the largest producer of rail-ties and utility poles in North America. The departure of the company’s long-time CEO caused some stock jitters last year. However, we have met the new CEO and believe he and the business remains solid. When combined with a more attractive valuation, we are excited in SJ long-term potential.

- MAV Beauty Brands Inc. (-5% since initial August 2019 investment) owns attractive brands used in hair and personal care. Since its 2018 IPO, the company has failed to meet guidance and the stock has suffered consequently. This created a nice entry point for us as we believe the business remains sound, cash generative, and growing overall.

HARD ASSETS: 6% Real Estate + 4% Infrastructure + 5% commodities

We believe real estate and infrastructure remain expensive overall: our exposure is limited to select opportunities where we see idiosyncratic value. Commodities may be an emerging opportunity, but it is hard to find quality.

- Mainstreet Equity Corp. (+90% in 2019) acquires, renovates, and operates low-end middle-class apartment buildings in Western Canada. Since the Alberta economic slowdown in 2014, MEQ has been active in acquisitions; growing its Alberta suite count from 5,300 to >7,000. This was a good strategy as the Alberta middle-class rental market improved significantly last year. MEQ was the top performing Canadian real estate stock in 2019.

Currencies/Credit: 7% cash + 0% Bonds

No change to our view that bonds are expensive: after tax and inflation, we believe most bonds are priced for prospective losses. Given this long-standing view, our fund does not own any fixed income.

INVESTMENT OUTLOOK

Where do we find value today?

Currently, we see value in smaller businesses that are publicly-traded and under-represented in indexes. This view has emerged as large cap stocks have significantly outperformed smaller ones over the last three years. Our growing small cap position may have been early, but we expect it to be rewarding long-term. In this outlook, we address why we see value in the space and what may be driving this discrepancy.

First, no change to our long-standing general thesis: businesses are undervalued relative to other asset classes like fixed income, real estate, and infrastructure. We have held this opinion since the inception of the fund and have written about it at length in these semi-annual reports.

Second, we find public valuations more attractive than private ones. Private equity strategies have seen booming inflows over the last decade, often at the expense of public equity strategies. This means a much larger amount of capital is seeking to buy privately owned business, creating bidding wars and higher valuations for private businesses. Today, when we compare similar businesses, one publicly owned versus one privately owned, we continually find more attractive valuations in the publicly-traded option.

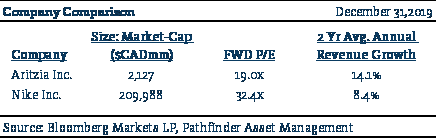

Third, we find small business valuations more attractive than large business valuations. The last decade has seen an emergence in passive investing strategies: where an investor invests in an ETF that owns all the businesses that make up a major index, without fundamentally researching what they own. This popular trend has resulted in large passive bids for large indexed companies. We believe this has stretched valuations for large indexed companies when compared to companies under-represented in a major index. For example, we compare under-represented Aritzia to well-represented mega-cap Nike below. While we are invested in both companies, Aritzia gives us higher growth at a much more attractive valuation; leading to a much higher weight in the fund.

So where do we find value today? We find value in what is being ignored in the current trends of private and passive investing: small public businesses that are under-represented in indexes. Given this view and the value we see in this space, the Real Fund has been shifting to smaller companies with a 55% weight in companies <$3.0B in size (as measured by market cap) including a 38% weight in companies <$1.0B in size. Given this position, our outlook for the future remains cautiously optimistic.

Final Remarks

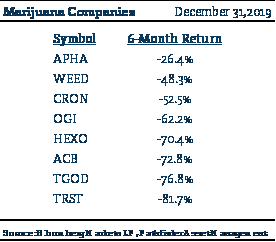

Six months ago, we spoke of euphoria and the dangerous emotion of “greed” that accompanies euphoric times. We provided a list of assets that faced extreme euphoria followed by an inevitable severe correction in price. We highlight that list again below:

- Technology Companies: 1999-2001

- Equities: 2006-2007

- Oil: 2011-2013

- Vancouver Real Estate: 2014-2016

- Cryptocurrencies: 2017

- Potentially, marijuana companies today

Fast forward six months and we can remove the “potentially” from marijuana companies. Over the last six months, marijuana companies have met the same fate: a severe correction in price (see below).

During the euphoric times that precede corrections like this, one of the greatest services we can provide clients is “emotional control”. In this case, controlling our greed. In accordance with the Real Fund’s mandate, we avoid investing in assets that we believe are in a euphoric state. For example, we have refrained from owning any marijuana companies. We also try to share why we are not investing in these assets so that it can aide clients in their decision making.

Thank-you for investing!

Christian Anthony, CFA | Portfolio Manager

“Passive investing is the bubble right now, and that’s a great danger.”– Carl Icahn

National Instrument 31-103 requires registered firms to disclose information that a reasonable investor would expect to know, including any material conflicts with the firm or its representatives. Doug Johnson and/or Pathfinder Asset Management Limited are an insider of companies periodically mentioned in this report. Please visit www.paml.ca for full disclosures.

*All returns are time weighted and net of fees. Performance returns from the Real Fund are presented based on the Class C Master series. Inception and 2013 returns include the 10 months from inception in March 2013. Returns greater than one year are annualized. The custom cost of living and CPI provide general information and should not be interpreted as a benchmark for your own portfolio return. The custom cost of living represents an equally weighted (at inception) basket of Teranet-National Bank National Composite House Price Index™, UBS E-TRACS CMCI Food Total Return ETN ETF (FUD:NYSE), United States Gasoline ETF (UGA:NYSE) and Canadian import prices from Statistics Canada in Canadian dollars. We created the custom cost of living index to give investors another way to measure their cost of living. It has some differences versus CPI; for example, CPI measures shelter costs as the cost of renting a home versus the custom index which measures it as at the cost of purchasing a home. A bachelor may view renting as an accurate gauge of shelter costs. On the other hand, a mother and father who want to raise their family under the security of the same roof without the risk of forced relocation likely views home ownership as a more accurate gauge of shelter costs.

Pathfinder Asset Management Limited (PAML) and its affiliates may collectively beneficially own in excess of 10% of one or more classes of the issued and outstanding equity securities mentioned in this newsletter. This publication is intended only to convey information. It is not to be construed as an investment guide or as an offer or solicitation of an offer to buy or sell any of the securities mentioned in it. The author has taken all usual and reasonable precautions to determine that the information contained in this publication has been obtained from sources believed to be reliable and that the procedures used to summarize and analyze such information are based on approved practices and principles in the investment industry. However, the market forces underlying investment value are subject to sudden and dramatic changes and data availability varies from one moment to the next. Consequently, neither the author nor PAML can make any warranty as to the accuracy or completeness of information, analysis or views contained in this publication or their usefulness or suitability in any particular circumstance. You should not undertake any investment or portfolio assessment or other transaction on the basis of this publication, but should first consult your portfolio manager, who can assess all relevant particulars of any proposed investment or transaction. PAML and the author accept no liability of any kind whatsoever or any damages or losses incurred by you as a result of reliance upon or use of this publication.