Reasons Why Inflation Readings May Increase

In the second part of our four-part inflation series, we wanted to identify several reasons why inflation appears likely to be increasing. The real question for investors is whether the reasons below are short-term (temporal) or if there is a good reason to expect that there has been a structural change to the investing environment. Below are several items that we will pay attention to in order to try to determine our view.

- Demand & supply imbalance: There is increasing evidence that the pandemic has impacted small businesses. This means that just as demand increases as vaccinations and herd immunity take hold, there will be constrained capacity to deal with the uptick. The result would be increased prices. There is potential that this could be temporary until new businesses open or permanent if businesses formation is truly impaired.

- Many businesses have adjusted the way they operate (more video commuting, offices moving away from downtown cores, changing global supply chains and holding more inventory). This is not as efficient as it was before and will impact productivity, thereby adding to inflationary pressures across all industries.

- “Comparables”: Consumer prices decreased last spring at the start of the recession. When this year’s pricing is compared with last year’s, it will look as if inflation has increased; but in reality, this could reflect last year’s price drop rather than an actual price increase. We call this “a tough comp” and it also happens regularly with financial results for the companies that we follow. The US Federal Open Market Committee (FOMC) has a soft target of 2% for inflation and it will look like we have passed through this target, just based on the math alone.

- Governments are stimulating with both fiscal and monetary measures but the FOMC has also guided that they will now target an average of 2% inflation which means that price increases would need to “run hot” and over 2% in order to bring average inflation up, as it has been so low for so long. This could give the impression that inflation is increasing in a potentially uncontrolled way. Financial markets do not like out-of-control inflation.

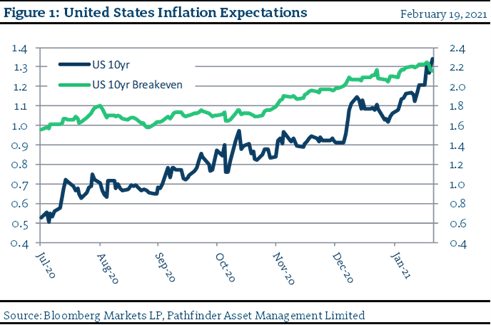

“This means that” while inflation expectations have somewhat stabilized over the past week, Figure 1 shows that the trend remains up. There are several reasons noted above for us to consider but the real question for us as investors is whether we should believe that the coming inflation is a long-term change or just temporal. We will discuss more next week.

National Instrument 31-103 requires registered firms to disclose information that a reasonable investor would expect to know, including any material conflicts with the firm or its representatives. Doug Johnson and/or Pathfinder Asset Management Limited are an insider of companies periodically mentioned in this report. Please visit www.paml.ca for full disclosures.

*All returns are time weighted and net of investment management fees. Returns from the Pathfinder Partners’ Fund and Pathfinder Real Fund are presented based on the masters series of each fund. The Pathfinder North American Equity Portfolio and The Pathfinder North American Income Portfolio are live accounts. These are actual accounts owned by the Pathfinder Chairman (Equity) and client (High Income) which contain no legacy positions, cash flows or other Pathfinder investment mandates or products. Monthly inception dates for each fund and portfolio are as follows: Pathfinder North American Equity Portfolio (January 2011), Pathfinder North American High-Income Portfolio (October 2012) Pathfinder Partners’ Fund (April 2011), Pathfinder Real Fund (April, 2013), and Pathfinder International Fund (November 2014).

Pathfinder Asset Management Limited (PAML) and its affiliates may collectively beneficially own in excess of 10% of one or more classes of the issued and outstanding equity securities mentioned in this newsletter. This publication is intended only to convey information. It is not to be construed as an investment guide or as an offer or solicitation of an offer to buy or sell any of the securities mentioned in it. The author has taken all usual and reasonable precautions to determine that the information contained in this publication has been obtained from sources believed to be reliable and that the procedures used to summarize and analyze such information are based on approved practices and principles in the investment industry. However, the market forces underlying investment value are subject to sudden and dramatic changes and data availability varies from one moment to the next. Consequently, neither the author nor PAML can make any warranty as to the accuracy or completeness of information, analysis or views contained in this publication or their usefulness or suitability in any particular circumstance. You should not undertake any investment or portfolio assessment or other transaction on the basis of this publication, but should first consult your portfolio manager, who can assess all relevant particulars of any proposed investment or transaction. PAML and the author accept no liability of any kind whatsoever or any damages or losses incurred by you as a result of reliance upon or use of this publication.