Recap & Macro Outlook: Canadian GDP

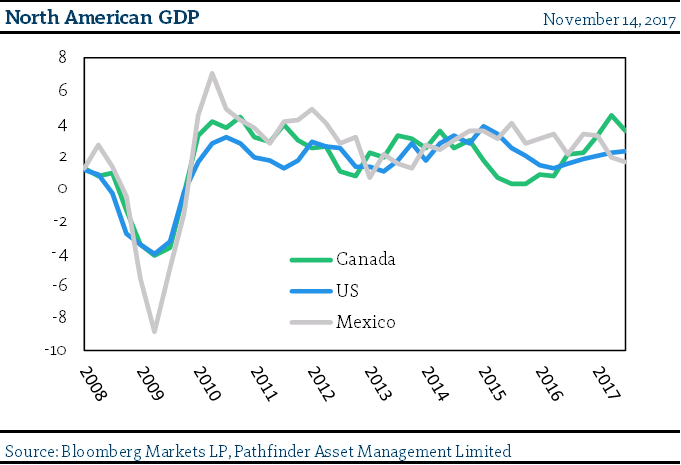

The chart below contains the quarterly GDP trends of the three NAFTA countries. The chart illustrates that while all three countries had a difficult period during the Great Recession (2008-2009), Mexico was by far the standout to the down side, but also had a stronger result on the back of the recovery. In 2015, it was Canada’s turn to underperform with the drop in the price of oil and other commodities in general. After Canada bottomed, the economy had a clear bounce back in tandem with the recovery in the price of oil and the continuing Canadian housing boom. We read this week that Statistics Canada had revised GDP higher for the 2015-2016 period meaning that the oil shock did not have as large an impact on our economy as originally thought. Recently, the Bank of Canada (BOC) released a somewhat more sanguine view of the prospects for Canada and also removed the accommodative interest rate policy that was put in place during the oil shock period. Our view is somewhat different than the BOC as we are more concerned about the price and size of the housing industry as a percentage of our GDP and the household debt that comes along with that.

If you look more closely at the last few data points in the chart, you can see that both Canadian and Mexican GDP appeared to peak recently. On the other hand, there appears to be little concern with the performance of the US economy, which continues to strengthen. One other item to note is that both Mexico and the US release their data on a quarterly basis. All of the data presented above is the for the most recent quarter (ending September). Canada does the same, but also provides a monthly data release. Earlier this year, our economy put in an impressive performance but over the summer, July was flat and we actually had negative GDP in August. While it is possible that some of this could be temporary (manufacturing response to the hurricane and energy etc.) if the Canadian economy continues to slow at a time when the set up for US economic and inflation expectations are edging higher, we could see a more divergence between the Canadian and US central banks.

“This means that” forward expectations for inflation and interest rates could diverge between Canada and the US which would have implications for Canadian companies with US$ revenue and expenses. Canada reports GDP on December 1st so we will update you again with our view after we have had a chance to review the data.

National Instrument 31-103 requires registered firms to disclose information that a reasonable investor would expect to know, including any material conflicts with the firm or its representatives. Doug Johnson and/or Pathfinder Asset Management Limited are an insider of companies periodically mentioned in this report. Please visit www.paml.ca for full disclosures.

*All returns are time weighted and net of investment management fees. Returns from the Pathfinder Partners’ Fund and Partners’ Real Return Plus Fund are presented based on the masters series of each fund. The Pathfinder Core: Equity Portfolio and The Pathfinder Core: High Income Portfolio are live accounts. These are actual accounts owned by the Pathfinder CEO (Equity) and client (High Income) which contain no legacy positions, cash flows or other Pathfinder investment mandates or products. Monthly inception dates for each fund and portfolio are as follows: Pathfinder Core: Equity Portfolio (January 2011), Pathfinder Core: High Income Portfolio (October 2012) Partners’ Fund (April 2011), Partners’ Real Return Plus Fund (April, 2013), and Partners’ Core Plus Fund (November 2014).

Pathfinder Asset Management Limited (PAML) and its affiliates may collectively beneficially own in excess of 10% of one or more classes of the issued and outstanding equity securities mentioned in this newsletter. This publication is intended only to convey information. It is not to be construed as an investment guide or as an offer or solicitation of an offer to buy or sell any of the securities mentioned in it. The author has taken all usual and reasonable precautions to determine that the information contained in this publication has been obtained from sources believed to be reliable and that the procedures used to summarize and analyze such information are based on approved practices and principles in the investment industry. However, the market forces underlying investment value are subject to sudden and dramatic changes and data availability varies from one moment to the next. Consequently, neither the author nor PAML can make any warranty as to the accuracy or completeness of information, analysis or views contained in this publication or their usefulness or suitability in any particular circumstance. You should not undertake any investment or portfolio assessment or other transaction on the basis of this publication, but should first consult your portfolio manager, who can assess all relevant particulars of any proposed investment or transaction. PAML and the author accept no liability of any kind whatsoever or any damages or losses incurred by you as a result of reliance upon or use of this publication.