Recap & Outlook: Vancouver Housing – Part IV

Over the last five years, we have written about Vancouver real estate and whether we think it is a good investment. Report one (July 2015) addressed why we thought Vancouver real estate was expensive; report two (August 2016) addressed factors driving Vancouver real estate prices higher despite being expensive; and report three (September 2018) addressed changes that were occurring in those factors that we thought would end the bull market.

In this follow-up report, we address the meaningful correction that has occurred and address whether we think real estate prices have fallen enough to now be viewed as attractive.

A Meaningful Correction

Last year, we concluded that higher interest rates, tighter lending standards, and significant incremental regulations on capital leaving China and entering B.C. would end the bull market in Vancouver real estate. After observing the market over the last year, it appears a meaningful correction is occurring:

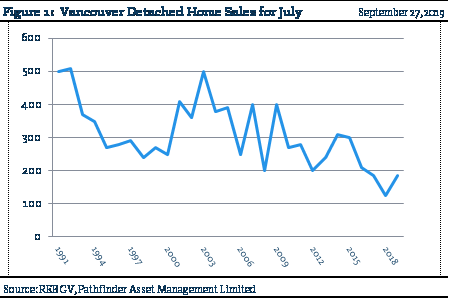

Sales volumes remain very low: As can be seen in Figure 1, volumes remain well below historic levels.

Prices are down significantly: one of the few homes sold in July was the house one of us at Pathfinder grew up in. It was sold at a price 37% lower than its selling price just nine months prior.

More extreme than Financial Crisis? As can be seen in Figure 2, that type of price correction is more extreme than what occurred at the beginning of the 2008 financial crisis. The question is does Vancouver approach or even exceed the ultimate correction during the financial crisis.

Have prices fallen enough?

While the home quoted above is just a single example, the core Vancouver market has seen a significant correction over the last 12 months. The question becomes whether prices have declined enough to now be considered an attractive investment. There are a couple factors supporting Vancouver real estate, but we believe the factors against ownership are still more significant:

For; Interest rates have fallen back down: The benchmark interest rate (5-year government bond) used in determining Canadian mortgages has fallen from 2.4% in November (2018) to 1.4% today.

For; Increased immigration from Hong Kong: A new wave of foreign capital could be hitting Vancouver from Hong Kong residents looking to leave Hong Kong due to the unrest. However, this wave should have far less impact than the prior wave from Mainland China. Firstly, the population of Hong Kong is 0.5% of Mainland China’s. Secondly, Hong Kong has always been a free trade hub so the capital has less of a “laundering” motive.

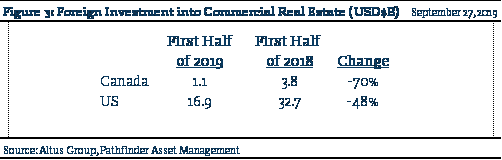

Against; Restriction on Chinese capital seems permanent: The length and level of sophistication China used to restrict capital leaving their country makes us believe it is long term. Figure 3 highlights that these restrictions are having a global impact but is likely most severe in Vancouver.

Against; Forced selling just starting: Historically, housing markets bottom when there is forced selling due to foreclosure, unaffordability, confiscation (bought with illegal capital). There are signs that this is just beginning in Vancouver. The Financial Times stated that in the first half of 2019, the Chinese became a net seller of assets outside its country for the first time in a decade.

Against; Still WAY overvalued: Going back to our inaugural report in 2015, Vancouver real estate (even now) does not generate enough net rental income to justify its price. We re-ran the math to factor lower prices, increased cost of ownership due to incremental taxes, and decreased rental rates from the vacant home tax. Our conclusion is that there are still other assets that are much more attractively valued, and it is still much better to rent versus own.

“This means that” Vancouver real estate has seen a significant correction. Even at its lower price, it still fails to meet our definition of a good investment. Further, there could be significant more downside as a wave of sellers (China, developers, presales, unaffordable mortgages) could dwarf incremental buyers coming from Hong Kong and lower rates.

National Instrument 31-103 requires registered firms to disclose information that a reasonable investor would expect to know, including any material conflicts with the firm or its representatives. Doug Johnson and/or Pathfinder Asset Management Limited are an insider of companies periodically mentioned in this report. Please visit www.paml.ca for full disclosures.

*All returns are time weighted and net of investment management fees. Returns from the Pathfinder Partners’ Fund and Pathfinder Real Fund are presented based on the masters series of each fund. The Pathfinder North American: Equity Portfolio and The Pathfinder North American: High Income Portfolio are live accounts. These are actual accounts owned by the Pathfinder Chairman (Equity) and client (High Income) which contain no legacy positions, cash flows or other Pathfinder investment mandates or products. Monthly inception dates for each fund and portfolio are as follows: Pathfinder North American: Equity Portfolio (January 2011), Pathfinder North American: High Income Portfolio (October 2012) Pathfinder Partners’ Fund (April 2011), Pathfinder Real Fund (April, 2013), Pathfinder International Fund (November 2014) and Pathfinder Resource Fund (May 2018).

Pathfinder Asset Management Limited (PAML) and its affiliates may collectively beneficially own in excess of 10% of one or more classes of the issued and outstanding equity securities mentioned in this newsletter. This publication is intended only to convey information. It is not to be construed as an investment guide or as an offer or solicitation of an offer to buy or sell any of the securities mentioned in it. The author has taken all usual and reasonable precautions to determine that the information contained in this publication has been obtained from sources believed to be reliable and that the procedures used to summarize and analyze such information are based on approved practices and principles in the investment industry. However, the market forces underlying investment value are subject to sudden and dramatic changes and data availability varies from one moment to the next. Consequently, neither the author nor PAML can make any warranty as to the accuracy or completeness of information, analysis or views contained in this publication or their usefulness or suitability in any particular circumstance. You should not undertake any investment or portfolio assessment or other transaction on the basis of this publication, but should first consult your portfolio manager, who can assess all relevant particulars of any proposed investment or transaction. PAML and the author accept no liability of any kind whatsoever or any damages or losses incurred by you as a result of reliance upon or use of this publication.