Recap & Outlook: US Consumer Still King & Queen

There has been upheaval in financial markets this summer. Investor concern about the global economy has been well publicised but daily swings in stock markets have depended more on whether trade talks between the Chinese and US governments are “on” or “off” than on any fundamental basis. We see this in real time on the Pathfinder desk. Mark, our long-term trader (his first job was on the floor of the Vancouver Stock Exchange!!) told me that he has never seen “it” like this. As we have previously written in this note, it is our job to look past the headlines and flickering screens and to focus on the important stuff: i.e. How much cash will the companies that we own generate, and what is that worth to us. A major part of this calculus is the economy. Not the stock market, but the economy.

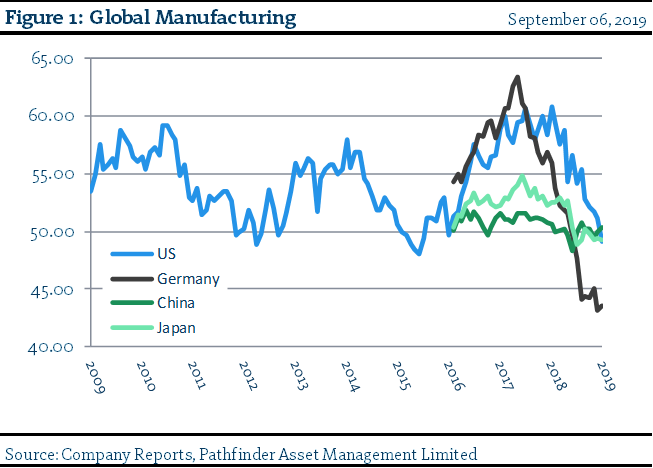

- Observable data indicates the global economy is slowing, especially from the industrial and manufacturing side. This was demonstrated this week with the US ISM data (please see Figure 1). We have also included other major economies.

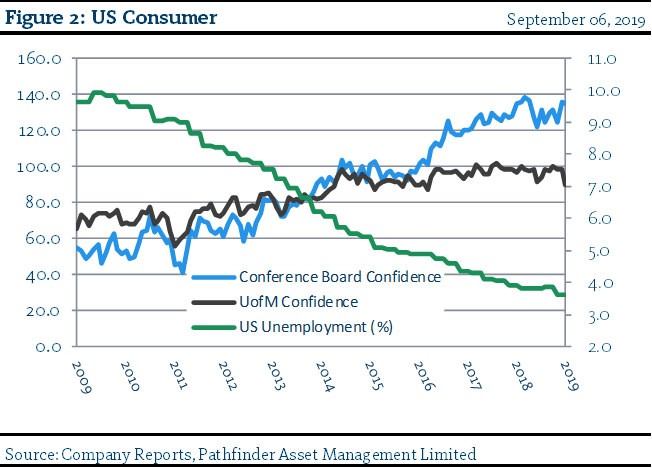

- The bright spot continues to be the US consumer. Figure 2 demonstrate that the consumer, which represents two thirds of the US economy, remains healthy and confident. If this were to change, all else being equal, we would become concerned.

- Our real concern is more about protectionism. If consumption is stifled from trade wars and sanctions, there could be problems. Central banks have made it clear they would provide monetary stimulus (China did so on Friday with a required reserve ratio cut of 50bps, for example) if this happened but our fear is that that may not be enough.

“This means that” we maintain our view that the global economy does not appear at this point to be moving into recession anytime soon (growth is still positive, although it has slowed). A recession, much like a forest fire, is a natural part of the cycle that cleans up inefficiency and allows for rebirth. It is also inevitable. We, however, remain steadfast in our investment process and focused on investing in good quality firms that generate cash flow and then reinvest that cash flow back in their business and/or rationally distribute it back to their owners (i.e. us).

National Instrument 31-103 requires registered firms to disclose information that a reasonable investor would expect to know, including any material conflicts with the firm or its representatives. Doug Johnson and/or Pathfinder Asset Management Limited are an insider of companies periodically mentioned in this report. Please visit www.paml.ca for full disclosures.

*All returns are time weighted and net of investment management fees. Returns from the Pathfinder Partners’ Fund and Partners’ Real Return Plus Fund are presented based on the masters series of each fund. The Pathfinder Core: Equity Portfolio and The Pathfinder Core: High Income Portfolio are live accounts. These are actual accounts owned by the Pathfinder Chairman (Equity) and client (High Income) which contain no legacy positions, cash flows or other Pathfinder investment mandates or products. Monthly inception dates for each fund and portfolio are as follows: Pathfinder North American: Equity Portfolio (January 2011), Pathfinder North American: High Income Portfolio (October 2012) Pathfinder Partners’ Fund (April 2011), Pathfinder Real Return Plus Fund (April, 2013), Pathfinder International Fund (November 2014) and Pathfinder Resource Fund (May 2018).

Pathfinder Asset Management Limited (PAML) and its affiliates may collectively beneficially own in excess of 10% of one or more classes of the issued and outstanding equity securities mentioned in this newsletter. This publication is intended only to convey information. It is not to be construed as an investment guide or as an offer or solicitation of an offer to buy or sell any of the securities mentioned in it. The author has taken all usual and reasonable precautions to determine that the information contained in this publication has been obtained from sources believed to be reliable and that the procedures used to summarize and analyze such information are based on approved practices and principles in the investment industry. However, the market forces underlying investment value are subject to sudden and dramatic changes and data availability varies from one moment to the next. Consequently, neither the author nor PAML can make any warranty as to the accuracy or completeness of information, analysis or views contained in this publication or their usefulness or suitability in any particular circumstance. You should not undertake any investment or portfolio assessment or other transaction on the basis of this publication, but should first consult your portfolio manager, who can assess all relevant particulars of any proposed investment or transaction. PAML and the author accept no liability of any kind whatsoever or any damages or losses incurred by you as a result of reliance upon or use of this publication.