Supply Chain & Rates

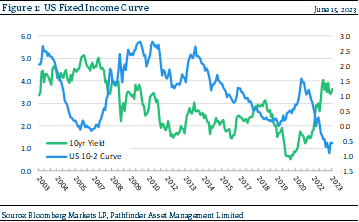

This week, we write on two topics. First, the US Federal Open Market Committee (FOMC) voted to hold rates steady on Wednesday, as the futures curve that we previously noted in this Outlook indicated. It now looks like the curve, and the FOMC are implying 1-2 more 25 basis point hikes until a potential peak is reached at 5.6-5.75% in the next 6 months or so. This is a change from a month ago, which means that the market is implying that inflation will remain somewhat sticky. It is worth noting that both the market and the FOMC believe that over time, inflation will settle back down to a long run rate of 2.5%. The last US CPI reading was 4.0%, so they have some work to do to get there. Many commentators suspect that rates will be held high until economic data softens. Then they will be reduced quickly to avoid a recession. Figure 1 presents the US fixed income market. As you can see, it has changed dramatically since 2019.

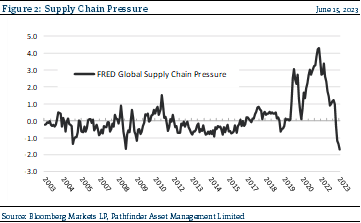

Second, we found some data with respect to the global supply chain from the New York Fed database that we really like. From their website: “Our research indicates that changes in the GSCPI are associated with goods and producer price inflation in the United States and the euro area, both during the pandemic period and before…”. The index focuses on marine and air freight, as well as supply chain data from PMI surveys, of interlinked economies like China, the euro area, Japan, South Korea, Taiwan, the United Kingdom, and the United States. As you can see from Figure 2, after peaking in 2022, supply chain stress has dropped substantially. This is consistent with our view that there are very broad forces, initially created from the mitigation measures from the pandemic, at play. We are now in a period of loose supply… verses early 2022 when it was extremely tight. This is a positive development.

“This means that” for the rates point, we tend to agree that the FOMC is in a good spot and can hold rates at these or close to these levels for some time, and hopefully ease into a soft landing. With respect to the global supply chain, we are glad to see that the pressure has been removed from the system. It makes the inflation fight easier at the margin for the FOMC.

National Instrument 31-103 requires registered firms to disclose information that a reasonable investor would expect to know, including any material conflicts with the firm or its representatives. Doug Johnson and/or Pathfinder Asset Management Limited are an insider of companies periodically mentioned in this report. Please visit www.paml.ca for full disclosures.

Changes in Leverage. We are increasing the asset ceiling to 2.0 times the market value of equity for Pathfinder International Fund and Pathfinder Real Fund to be consistent with Pathfinder Partners’ Fund and Pathfinder Resource Fund.

*All returns are time weighted and net of investment management fees. Returns from the Pathfinder Partners’ Fund and Partners’ Real Return Plus Fund are presented based on the masters series of each fund. The Pathfinder Core: Equity Portfolio and The Pathfinder Core: High Income Portfolio are live accounts. These are actual accounts owned by the Pathfinder Chairman (Equity) and client (High Income) which contain no legacy positions, cash flows or other Pathfinder investment mandates or products. Monthly inception dates for each fund and portfolio are as follows: Pathfinder Core: Equity Portfolio (January 2011), Pathfinder Core: High Income Portfolio (October 2012) Partners’ Fund (April 2011), Partners’ Real Return Plus Fund (April, 2013), and Partners’ Core Plus Fund (November 2014).

Pathfinder Asset Management Limited (PAML) and its affiliates may collectively beneficially own in excess of 10% of one or more classes of the issued and outstanding equity securities mentioned in this newsletter. This publication is intended only to convey information. It is not to be construed as an investment guide or as an offer or solicitation of an offer to buy or sell any of the securities mentioned in it. The author has taken all usual and reasonable precautions to determine that the information contained in this publication has been obtained from sources believed to be reliable and that the procedures used to summarize and analyze such information are based on approved practices and principles in the investment industry. However, the market forces underlying investment value are subject to sudden and dramatic changes and data availability varies from one moment to the next. Consequently, neither the author nor PAML can make any warranty as to the accuracy or completeness of information, analysis or views contained in this publication or their usefulness or suitability in any particular circumstance. You should not undertake any investment or portfolio assessment or other transaction on the basis of this publication, but should first consult your portfolio manager, who can assess all relevant particulars of any proposed investment or transaction. PAML and the author accept no liability of any kind whatsoever or any damages or losses incurred by you as a result of reliance upon or use of this publication.