Thoughts on the Economy

Over the past few issues, we have digressed from our regular writing to address the Canadian Federal Budget and financial planning issues with respect to Wealth Accumulation and Preservation. Now we revert back to the state of the economy and markets for the next several issues of the Investment Outlook. It has been helpful to let a few weeks pass. The “Spring of 2023 Banking Crisis” was a serious event. Letting some time go by has allowed us to step back to see the effects it had on the trajectory of the economy, wages and ultimately inflation.

From our various research and readings over the past six weeks, we believe that we can conclude that the bank failure did in fact have some effect on the economy. Central bankers, heads of large money center banks and CEOs of large companies have all indicated that the crisis has impacted credit markets. This essentially serves to slow the economy as both the availability and cost of credit have increased. For a period of time, it also seemed it had essentially forced the US Fed’s hand and the FOMC would either have to halt future rate increases or even potentially cuts.

This led us to conclude that an economic slowdown is underway. Several CEOs of companies have indicated the same in recent quarterly conference calls. The CFO of Ziprecruiter noted the following – “I just want to start by saying some things as plainly as possible, which is, clearly, we’re in a macroeconomic slowdown. And online recruiting has effectively cooled across the country…”. Furthermore, our daily investment calls have noted the softening of manufacturing data.

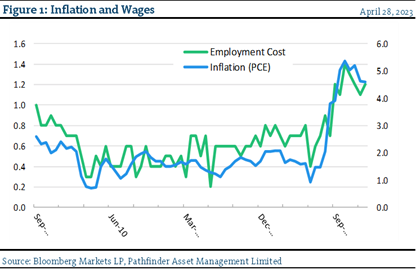

There was a “slew” of data released from around the world today with respect to inflation, economic growth and wages. Generally, we have concluded that in Europe, inflation remains elevated (7% on average) and GDP remains low (between 0%-1% growth for the majors). The situation is a little better in Asia, with China and Japan on very different tracks than Europe. In the US, the PCE deflator (the FOMCs preferred inflation measure) remained unchanged, but too high. Personal wage growth has also accelerated, which is not great for inflation (Please see Figure 1), manufacturing is slowing but unemployment remains low. It is a puzzle.

This means that this debate is the most important discussion in finance. Will the “economy” fall into recession? Will we have a soft landing? Will inflation come under control? These are all very good questions that we continue to be laser focused on. Currently, we believe that some type of recession is coming. It is part of the natural process and will have significant implications for how we position our investment portfolios.

National Instrument 31-103 requires registered firms to disclose information that a reasonable investor would expect to know, including any material conflicts with the firm or its representatives. Doug Johnson and/or Pathfinder Asset Management Limited are an insider of companies periodically mentioned in this report. Please visit www.paml.ca for full disclosures.

Changes in Leverage. We are increasing the asset ceiling to 2.0 times the market value of equity for Pathfinder International Fund and Pathfinder Real Fund to be consistent with Pathfinder Partners’ Fund and Pathfinder Resource Fund.

*All returns are time weighted and net of investment management fees. Returns from the Pathfinder Partners’ Fund and Partners’ Real Return Plus Fund are presented based on the masters series of each fund. The Pathfinder Core: Equity Portfolio and The Pathfinder Core: High Income Portfolio are live accounts. These are actual accounts owned by the Pathfinder Chairman (Equity) and client (High Income) which contain no legacy positions, cash flows or other Pathfinder investment mandates or products. Monthly inception dates for each fund and portfolio are as follows: Pathfinder Core: Equity Portfolio (January 2011), Pathfinder Core: High Income Portfolio (October 2012) Partners’ Fund (April 2011), Partners’ Real Return Plus Fund (April, 2013), and Partners’ Core Plus Fund (November 2014).

Pathfinder Asset Management Limited (PAML) and its affiliates may collectively beneficially own in excess of 10% of one or more classes of the issued and outstanding equity securities mentioned in this newsletter. This publication is intended only to convey information. It is not to be construed as an investment guide or as an offer or solicitation of an offer to buy or sell any of the securities mentioned in it. The author has taken all usual and reasonable precautions to determine that the information contained in this publication has been obtained from sources believed to be reliable and that the procedures used to summarize and analyze such information are based on approved practices and principles in the investment industry. However, the market forces underlying investment value are subject to sudden and dramatic changes and data availability varies from one moment to the next. Consequently, neither the author nor PAML can make any warranty as to the accuracy or completeness of information, analysis or views contained in this publication or their usefulness or suitability in any particular circumstance. You should not undertake any investment or portfolio assessment or other transaction on the basis of this publication, but should first consult your portfolio manager, who can assess all relevant particulars of any proposed investment or transaction. PAML and the author accept no liability of any kind whatsoever or any damages or losses incurred by you as a result of reliance upon or use of this publication.