Update of Previous data

Last week, we wrote about the job situation in the US, which continues to be difficult. In previous issues, we had highlighted data from different parts of the world to try to draw conclusions about the trajectory of the global economy. This week, we provide updates from these countries with respect to manufacturing, housing and consumer confidence. In a normal investment environment, this data would be relatively slow moving and less topical but in the current situation, the high frequency (i.e. monthly & weekly) data is top of mind.

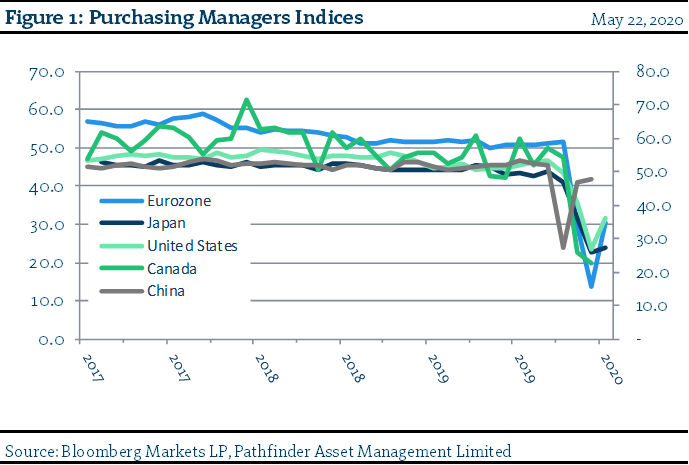

- Figure 1 presents PMI data for various countries. We often reference Purchasing Managers’ Indices (PMI) in our analysis. They are surveys of manager intentions and can be view as somewhat forward looking. A measure above 50 indicates expansionary activity among managers, while below 50 indicates contraction. As you can see from the data, there has been a slight bounce back in manager expectations but in major economies of the world, other than China, managers still experience contraction in their businesses.

- Figure 2 is US housing sales which has dropped dramatically this past month, much the same as the performance of the Great Financial Recession in 2008/9. This is backward-looking data as opposed to the other two charts which are related to forward expectations.

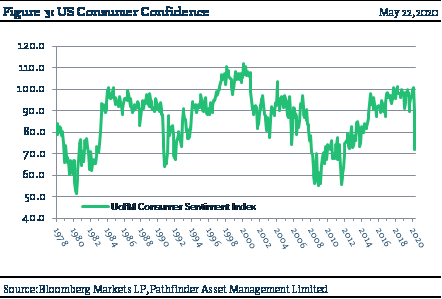

- Figure 3 presents consumer confidence data produced by the University of Michigan from the US. It is low but not as low as it can get historically. It is also hard to see in this chart but much like the PMI data in Figure 1 confidence has taken a slight uptick last month.

“This means that” while the data is still indicating that the world economy has been damaged, there is some improvement in sentiment, which is positive on the margin. Other than China, which has bounced back in most sectors to pre-pandemic levels, global economic activity remains lower than normal.

National Instrument 31-103 requires registered firms to disclose information that a reasonable investor would expect to know, including any material conflicts with the firm or its representatives. Doug Johnson and/or Pathfinder Asset Management Limited are an insider of companies periodically mentioned in this report. Please visit www.paml.ca for full disclosures.

*All returns are time weighted and net of investment management fees. Returns from the Pathfinder Partners’ Fund and Pathfinder Real Fund are presented based on the masters series of each fund. The Pathfinder North American Equity Portfolio and The Pathfinder North American Income Portfolio are live accounts. These are actual accounts owned by the Pathfinder Chairman (Equity) and client (High Income) which contain no legacy positions, cash flows or other Pathfinder investment mandates or products. Monthly inception dates for each fund and portfolio are as follows: Pathfinder North American Equity Portfolio (January 2011), Pathfinder North American High-Income Portfolio (October 2012) Pathfinder Partners’ Fund (April 2011), Pathfinder Real Fund (April, 2013), and Pathfinder International Fund (November 2014).

Pathfinder Asset Management Limited (PAML) and its affiliates may collectively beneficially own in excess of 10% of one or more classes of the issued and outstanding equity securities mentioned in this newsletter. This publication is intended only to convey information. It is not to be construed as an investment guide or as an offer or solicitation of an offer to buy or sell any of the securities mentioned in it. The author has taken all usual and reasonable precautions to determine that the information contained in this publication has been obtained from sources believed to be reliable and that the procedures used to summarize and analyze such information are based on approved practices and principles in the investment industry. However, the market forces underlying investment value are subject to sudden and dramatic changes and data availability varies from one moment to the next. Consequently, neither the author nor PAML can make any warranty as to the accuracy or completeness of information, analysis or views contained in this publication or their usefulness or suitability in any particular circumstance. You should not undertake any investment or portfolio assessment or other transaction on the basis of this publication, but should first consult your portfolio manager, who can assess all relevant particulars of any proposed investment or transaction. PAML and the author accept no liability of any kind whatsoever or any damages or losses incurred by you as a result of reliance upon or use of this publication.