Weathering the Storm

The continued weakness in the market is being felt across all sectors, leaving very few places to “hide” in terms of investing. Overall, sentiment in our opinion is mixed as we get glimpses of a market rally, but these rallies have been short lived. With these false starts in mind, we’ve been selective of the companies we have invested in, focusing on quality assets with strong balance sheets. Most investors see downturns as an opportunity to buy. Similarly, good companies will recognize weakness in their share price and deploy capital to buy-back shares of their own companies or increase dividends, creating value for the shareholders. We touched on the psychology of investing over the last few weeks in our previous PIOs and reiterate that investors continue to watch for investment opportunities in high-quality companies. We have also been active in the Resource Fund, looking for new opportunities, diversification, and repositioning our portfolio into larger weights of high-quality companies such as Geodrill (TSX:GEO).

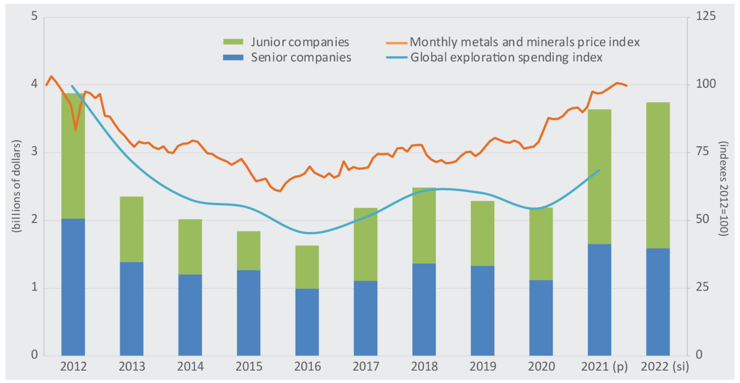

Figure 1: Global exploration expenditures outlook compared to minerals price index (NRCAN 2022).

As the name suggests, GEO is an exploration drilling company with operations mainly focused on West Africa. As companies around the world look to replenish mineral reserves, there has been an uptick in exploration budgets over the last few years (figure 1), which has translated into strong growth and financial results. GEO is attractively valued, trading at a 4x price to earnings ratio and at 2.5x EBITDA with a strong balance sheet (net cash ~US$2.4 M). The company is also well positioned in terms of secured contracts. Since the beginning of the year, GEO has closed on three significant long-term drilling contracts with top tier mining companies and a +70% drill fleet utilization. Geodrill also announced their intention to purchase up to 5% of the issued and outstanding shares while delivering a semi-annual dividend to shareholders for 2022. With long term contracts in place and strong revenue growth outlook, we believe Geodrill offers an opportunity to participate in the looming commodities upcycle without exposure to inflationary costs experienced by mining companies.

“This means that” weathering the storm is never easy but if you have conviction in high-quality assets, then the best course of action is to ride out these downturns. Many of these companies are over-sold based on sentiment rather than fundamental flaws, offering investors attractive entry points.

National Instrument 31-103 requires registered firms to disclose information that a reasonable investor would expect to know, including any material conflicts with the firm or its representatives. Doug Johnson and/or Pathfinder Asset Management Limited are an insider of companies periodically mentioned in this report. Please visit www.paml.ca for full disclosures.

*All returns are time weighted and net of investment management fees. Returns from the Pathfinder Partners’ Fund and Partners’ Real Return Plus Fund are presented based on the masters series of each fund. The Pathfinder Core: Equity Portfolio and The Pathfinder Core: High Income Portfolio are live accounts. These are actual accounts owned by the Pathfinder Chairman (Equity) and client (High Income) which contain no legacy positions, cash flows or other Pathfinder investment mandates or products. Monthly inception dates for each fund and portfolio are as follows: Pathfinder Core: Equity Portfolio (January 2011), Pathfinder Core: High Income Portfolio (October 2012) Partners’ Fund (April 2011), Partners’ Real Return Plus Fund (April, 2013), and Partners’ Core Plus Fund (November 2014).

Pathfinder Asset Management Limited (PAML) and its affiliates may collectively beneficially own in excess of 10% of one or more classes of the issued and outstanding equity securities mentioned in this newsletter. This publication is intended only to convey information. It is not to be construed as an investment guide or as an offer or solicitation of an offer to buy or sell any of the securities mentioned in it. The author has taken all usual and reasonable precautions to determine that the information contained in this publication has been obtained from sources believed to be reliable and that the procedures used to summarize and analyze such information are based on approved practices and principles in the investment industry. However, the market forces underlying investment value are subject to sudden and dramatic changes and data availability varies from one moment to the next. Consequently, neither the author nor PAML can make any warranty as to the accuracy or completeness of information, analysis or views contained in this publication or their usefulness or suitability in any particular circumstance. You should not undertake any investment or portfolio assessment or other transaction on the basis of this publication, but should first consult your portfolio manager, who can assess all relevant particulars of any proposed investment or transaction. PAML and the author accept no liability of any kind whatsoever or any damages or losses incurred by you as a result of reliance upon or use of this publication.